Question: please state whether the portfolio Is defensive or aggressive in table 2 also explain answers and show formulas where necessary. -0.0110 -0.0016 0.0056 Average Excess

please state whether the portfolio Is defensive or aggressive in table 2 also explain answers and show formulas where necessary.

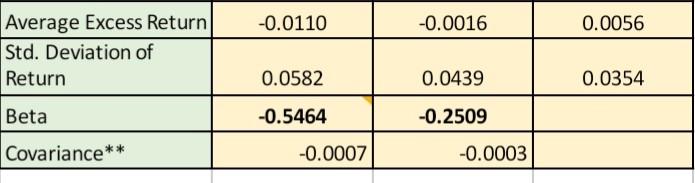

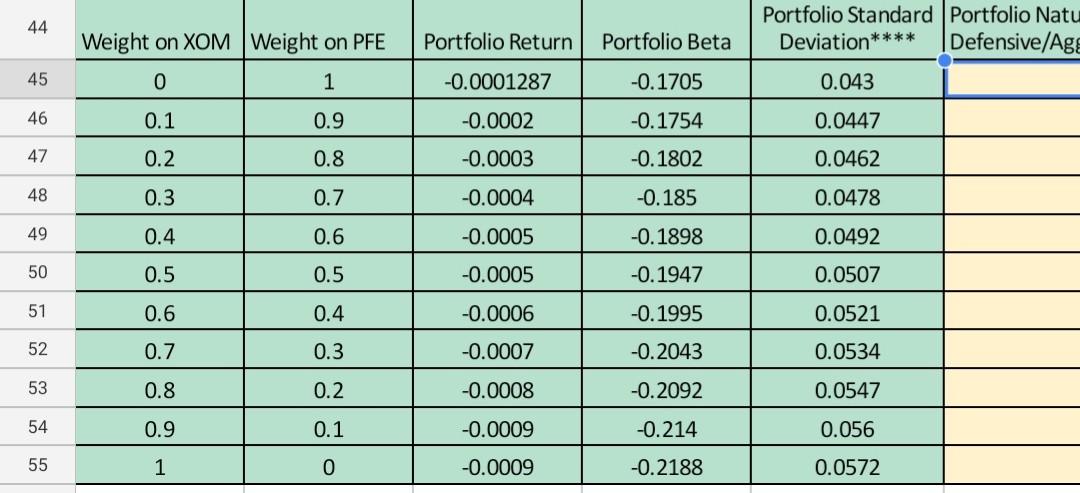

-0.0110 -0.0016 0.0056 Average Excess Return Std. Deviation of Return 0.0582 0.0439 0.0354 Beta -0.5464 -0.2509 Covariance** -0.0007 -0.0003 44 Weight on XOM Weight on PFE Portfolio Return Portfolio Beta Portfolio Standard Portfolio Natu Deviation**** Defensive/Agg 0.043 45 0 1 -0.0001287 -0.1705 46 0.1 0.9 -0.0002 -0.1754 0.0447 47 0.2 0.8 -0.0003 -0.1802 0.0462 48 0.3 0.7 -0.0004 -0.185 0.0478 49 0.4 0.6 -0.0005 -0.1898 0.0492 50 0.5 0.5 -0.0005 -0.1947 0.0507 51 0.6 0.4 -0.0006 -0.1995 0.0521 52 0.7 0.3 -0.0007 -0.2043 0.0534 53 0.8 0.2 -0.0008 -0.2092 0.0547 54 0.9 0.1 -0.0009 -0.214 0.056 55 1 0 -0.0009 -0.2188 0.0572 -0.0110 -0.0016 0.0056 Average Excess Return Std. Deviation of Return 0.0582 0.0439 0.0354 Beta -0.5464 -0.2509 Covariance** -0.0007 -0.0003 44 Weight on XOM Weight on PFE Portfolio Return Portfolio Beta Portfolio Standard Portfolio Natu Deviation**** Defensive/Agg 0.043 45 0 1 -0.0001287 -0.1705 46 0.1 0.9 -0.0002 -0.1754 0.0447 47 0.2 0.8 -0.0003 -0.1802 0.0462 48 0.3 0.7 -0.0004 -0.185 0.0478 49 0.4 0.6 -0.0005 -0.1898 0.0492 50 0.5 0.5 -0.0005 -0.1947 0.0507 51 0.6 0.4 -0.0006 -0.1995 0.0521 52 0.7 0.3 -0.0007 -0.2043 0.0534 53 0.8 0.2 -0.0008 -0.2092 0.0547 54 0.9 0.1 -0.0009 -0.214 0.056 55 1 0 -0.0009 -0.2188 0.0572

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts