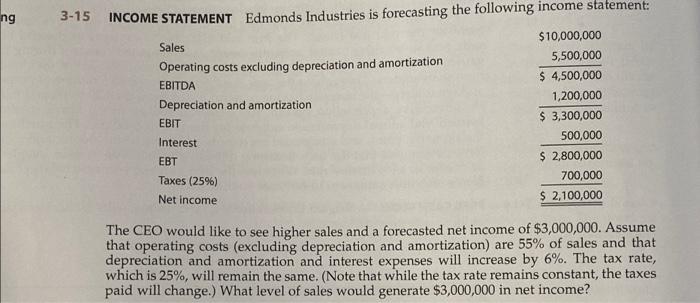

Question: Please step by step, excel!!! THANKS ng 3-15 INCOME STATEMENT Edmonds Industries is forecasting the following income statement: $10,000,000 Sales 5,500,000 Operating costs excluding depreciation

ng 3-15 INCOME STATEMENT Edmonds Industries is forecasting the following income statement: $10,000,000 Sales 5,500,000 Operating costs excluding depreciation and amortization $ 4,500,000 EBITDA 1,200,000 Depreciation and amortization $ 3,300,000 EBIT Interest 500,000 EBT $ 2,800,000 Taxes (259) 700,000 Net income $ 2,100,000 The CEO would like to see higher sales and a forecasted net income of $3,000,000. Assume that operating costs (excluding depreciation and amortization) are 55% of sales and that depreciation and amortization and interest expenses will increase by 6%. The tax rate, which is 25%, will remain the same. (Note that while the tax rate remains constant, the taxes paid will change.) What level of sales would generate $3,000,000 in net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts