Question: Please summarize below within 600-700 words. Link Manufacturing Process and Product Life Cycles Robert H. Hayes and Steven C. Wheelwright he regularity of the growth

Please summarize below within 600-700 words.

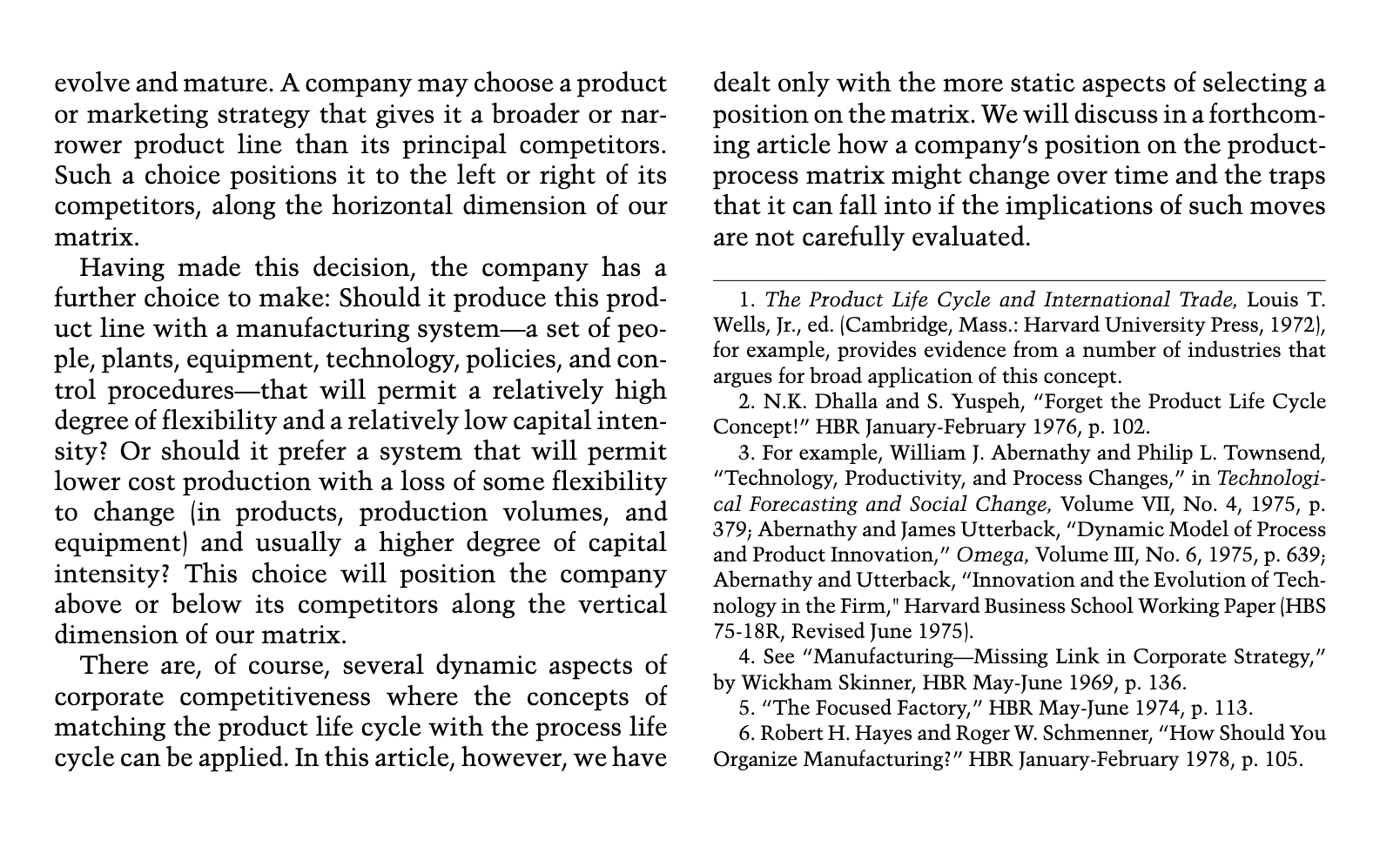

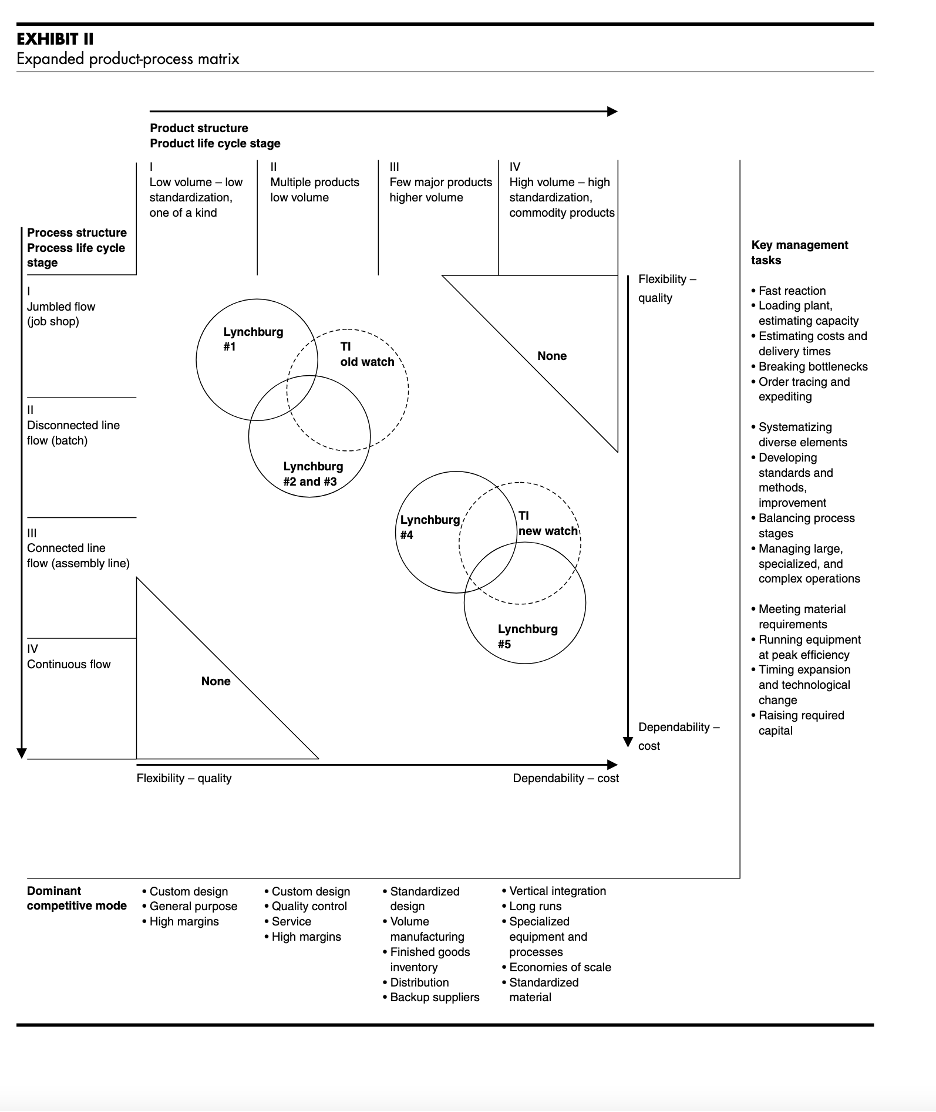

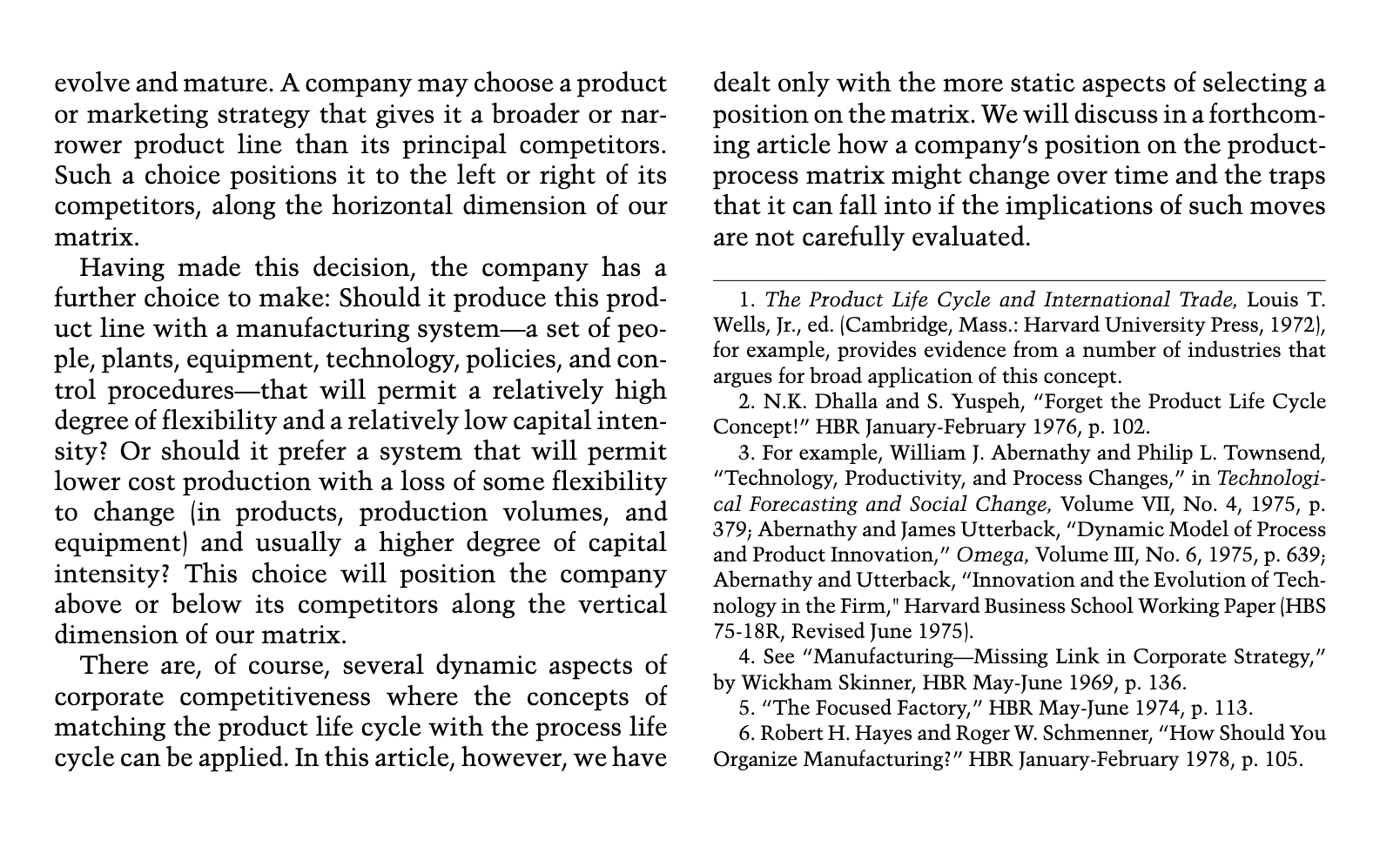

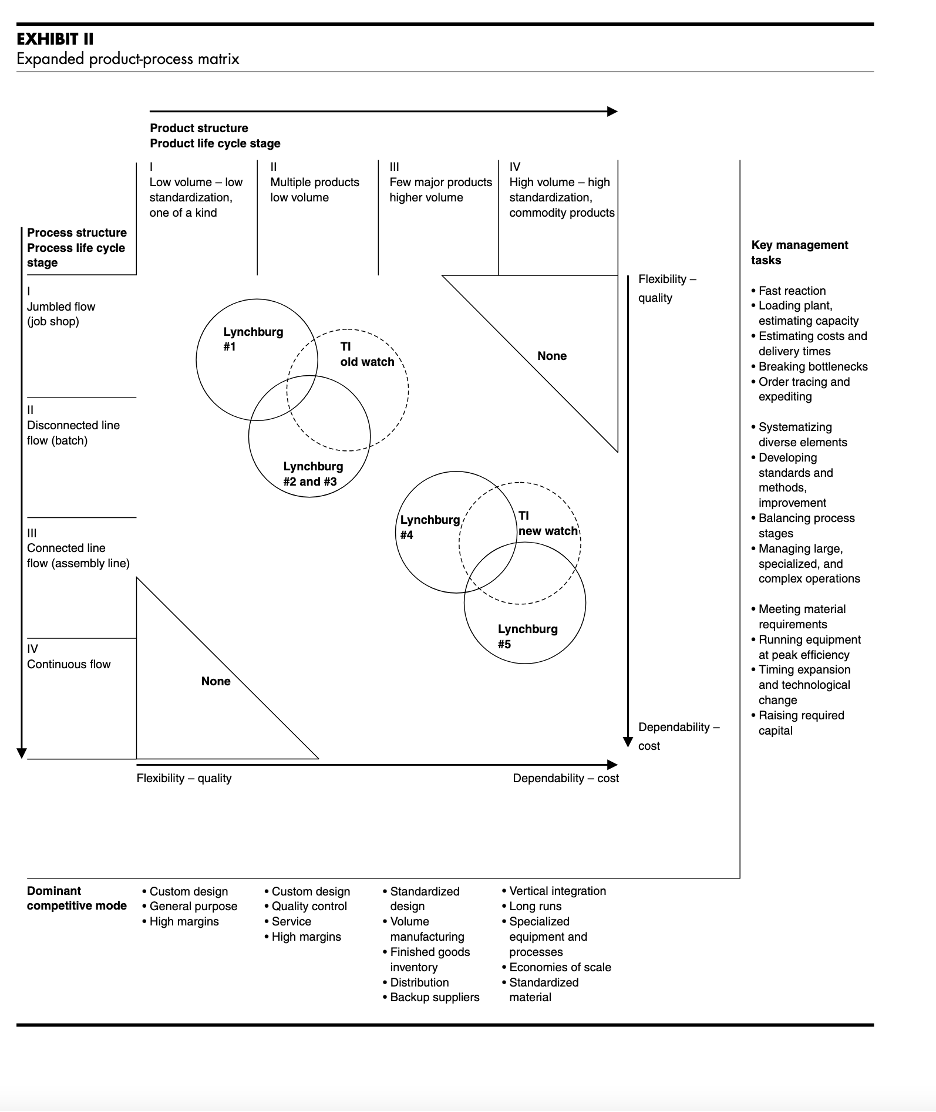

Link Manufacturing Process and Product Life Cycles Robert H. Hayes and Steven C. Wheelwright he regularity of the growth cycles of living organisms has always fascinated thoughtful tempts to apply the same principles-of a predictable sequence of rapid growth followed by maturation, decline, and death-to companies and selected indus- tries. One such concept, known as the "product life cycle," has been studied in a wide range of organiza- tional settings. However, there are sufficient oppos- ing theories to raise the doubts of people like N.K. Dhalla and S. Yuspeh, who argued in these same pages a few years ago that businessmen should forget the product life cycle concept. Irrespective of whether the product life cycle pat- tern is a general rule or holds only for specific cases, it does provide a useful and provocative framework for thinking about the growth and development of a new product, a company, or an entire industry. One of the major shortcomings of this approach, however, is that it concentrates on the marketing implications of the life cycle pattern. In so doing, it implies that other aspects of the business and industry environ- ment move in concert with the market life cycle. While such a view may help one to think back on the kinds of changes that occur in different industries, an individual company will often find it too simplistic for use in its strategic planning. In fact, the concept may even be misleading in strategic planning. In this article we suggest that separating the prod- uct life cycle concept from a related but distinct phenomenon that we will call the "process life cycle" facilitates the understanding of the strategic options available to a company, particularly with regard to its manufacturing function. THE PRODUCT-PROCESS MATRIX The process life cycle has been attracting increasing attention from business managers and researchers over the past several years. Just as a product and market pass through a series of major stages, so does the production process used in the manufacture of that product. The process evolution typically begins with a "fluid" process-one that is highly flexible, Mr. Hayes is professor of business administration at the Harvard Business School. He is currently serving as faculty chairman of and teaching at Harvard's Senior Managers Program in Vevey, Switzerland. One of his previous arti- cles in HBR is "How Should You Organize Manufactur- ing?" (coauthor, Roger W. Schmenner, January-February 1978). Mr. Wheelwright is associate professor of business administration the Harvard Business School. He currently teaching in the MBA program and is faculty chairman of Harvard's executive program on Manufactur- ing in Corporate Strategy. One of his previous HBR articles is "Corporate Forecasting: Promise and Reality," (coauthor, Darral G. Clarke, November-December 1976). but not very cost efficient and proceeds toward in- creasing standardization, mechanization, and auto- mation. This evolution culminates in a "systemic process" that is very efficient but much more capital intensive, interrelated, and hence less flexible than the original fluid process. Using a product-process matrix, Exhibit I suggests one way in which the interaction of both the product and the process life cycle stages can be represented. The rows of this matrix represent the major stages through which a production process tends to pass in going from the fluid form in the top row to the systemic form in the bottom row. The columns rep- resent the product life cycle phases, going from the great variety associated with startup on the left-hand side to standardized commodity products on the right-hand side. Diagonal position A company (or a business unit within a diversified company) can be characterized as occupying a par- ticular region in the matrix, determined by the stage of the product life cycle and its choice of production process for that product. Some simple examples may clarify this. Typical of a company positioned in the upper left-hand corner is a commercial printer. In such a company, each job is unique and a jumbled flow or job shop process is usually selected as being most effective in meeting those product require- ments. In such a job shop, jobs arrive in different forms and require different tasks, and thus the equip- ment tends to be relatively general purpose. Also, that equipment is seldom used at 100% capacity, the workers typically have a wide range of produc- tion skills, and each job takes much longer to go through the plant than the labor hours required by that job. Further down the diagonal in this matrix, the manufacturer of heavy equipment usually chooses a production structure characterized as a "discon- nected line flow" process. Although the company may make a number of products (a customer may even be able to order a somewhat customized unit), economies of scale in manufacturing usually lead such companies to offer several basic models with a variety of options. This enables manufacturing to move from a job shop to a flow pattern in which batches of a given model proceed irregularly through series of work stations, or pos even low volume assembly line. Even further down the diagonal, for a product like automobiles or major home appliances, a company will generally choose to make only a few models and use a relatively mechanized and connected produc- tion process, such as a moving assembly line. Such a process matches the product life cycle requirements that the automobile companies must satisfy with the economies available from a standardized and auto- mated process. Finally, down in the far right-hand corner of the matrix, one would find refinery operations, such as oil or sugar processing, where the product is a com- modity and the process is continuous. Although such operations are highly specialized, inflexible, and capi- tal intensive, their disadvantages are more than offset by the low variable costs rising from a high volume passing through a standardized process. In Exhibit I, two corners in the matrix are void of industries or individual companies. The upper right- hand corner characterizes a commodity product pro- duced by a job-shop process that is simply not eco- nomical. Thus there are no companies or industries located in that sector. Similarly, the lower left-hand corner represents a one-of-a-kind product that is made by continuous very specific processes. Such processes are simply too inflexible for such unique product requirements. Off the diagonal The examples cited thus far have been the more familiar "diagonal cases," in which a certain kind of product structure is matched with its "natural" pro- cess structure. But a company may seek a position off the diagonal instead of right on it, to its competitive advantage. Rolls-Royce Ltd. still makes a limited product line of motor cars using a process that is more like a job shop than an assembly line. A company that allows itself to drift from the diagonal without under- standing the likely implications of such a shift is asking for trouble. This is apparently the case with several companies in the factory housing industry that allowed their manufacturing operations to be- come too capital intensive and too dependent on stable, high-volume production in the early 1970s. As one might expect, when a company moves too far away from the diagonal, it becomes increasingly dissimilar from its competitors. This may or may not, depending on its success in achieving focus and ex- ploiting the advantages of its niche, make it more vulnerable to attack. Coordinating marketing and manufacturing may become more difficult as the two areas confront increasingly different opportunities and pressures. Not infrequently, companies find that either inadvertently or by conscious choice they are at positions on the: very dissimilar from those of their competitors and must consider drastic reme- dial action. Most small companies that enter a ma- ture industry start off this way, of course, which provides one explanation of both the strengths and the weaknesses of their situation. One example of a company's matching its move- ments on these two dimensions with changes in its industry is that of Zenith Radio Corporation in the mid-1960s. Zenith had generally followed a strategy of maintaining a high degree of flexibility in its manu- facturing facilities for color television receivers. We would characterize this process structure at that time as being stage 2. When planning additional capacity for color TV manufacturing in 1966 (during the height of the rapid growth in the market), however, Zenith chose to expand production capacity in a way that represented a clear move down the process dimen- sion, toward the matrix diagonal, by consolidating color TV assembly in two large plants. One of these was in a relatively low-cost labor area in the United States. While Zenith continued to have facilities that were more flexible than those of other companies in the industry, this decision reflected corporate man- agement's assessment of the need to stay within range of the industry on the process dimension so that its excellent marketing strategy would not be con- strained by inefficient manufacturing. It is interesting that seven years later Zenith made a similar decision to keep all of its production of color television chassis in the United States, rather than lose the flexibility and incur the costs of moving produc- tion to the Far East. This decision, in conjunction with others made in the past five years, is now being called into question. Using our terminology, Zenith again finds itself too far above the diagonal, in comparison with its large, primarily Japanese, competitors, most of whom have mechanized their production processes, positioned them in low-wage countries, and embarked on other cost-reduction programs. Incorporating this additional dimension into stra- tegic planning encourages more creative thinking about organizational competence and competitive advantage. It also can lead to more informed predic- tions about the changes that are likely to occur in a particular industry and to consideration of the strate- gies that might be followed in responding to such charges. Finally, it provides a natural way to involve manufacturing managers in the planning process so that they can relate their opportunities and decisions more effectively with marketing strategy and corpo- rate goals. The experience of the late 1960s and early 1970s suggests that major competitive advantages can accrue to companies that are able to integrate their manufacturing and marketing organization with a common strategy. USING THE CONCEPT We will explore three issues that follow from the product-process life cycle: (1) the concept of distinc- tive competence, (2) the management implications of selecting a particular product-process combination, considering the competition, and (3) the organizing of different operating units so that they can specialize on separate portions of the total manufacturing task while still maintaining overall coordination. Distinctive competence Most companies like to think of themselves as being particularly good relative to their competitors in certain areas, and they try to avoid competition in others. Their objective is to guard this distinctive competence against outside attacks or internal aim- lessness and to exploit it where possible. From time to time, unfortunately, management becomes preoc- cupied with marketing concerns and loses sight of the value of manufacturing abilities. When this happens, it thinks about strategy in terms only of the product and market dimension within a product life cycle context. In effect, management concentrates re- sources and planning efforts on a relatively narrow column of the matrix shown in Exhibit I on page 4. The advantage of the two-dimensional point of view is that it permits a company to be more precise about what its distinctive competence really is and to concentrate its attentions on a restricted set of process decisions and alternatives, as well as a re- stricted set of marketing alternatives. Real focus is maintained only when the emphasis is on a single "patch" in the matrix-a process focus as well as a product or market focus. As suggested by Wickham Skinner, narrowing the focus of the business unit's activities may greatly increase the chance of success for the organization.5 Thinking about both process and product dimen- sions can affect the way a company defines its "prod- uct." For example, we recently explored the case of a specialized manufacturer of printed circuit boards. Management's initial assessment of its position on the matrix was that it was producing a low-volume, one-of-a-kind product using a highly connected as- sembly line process. (This would place it in the lower left corner of the matrix.) On further reflection, how- ever, management decided that while the company specialized in small production batches, the "prod- uct" it really was offering was a design capability for special purpose circuit boards. In a sense, then, it was mass producing designs rather than boards. Hence, the company was not far off the diagonal after all. This knowledge of the company's distinctive compe- tence was helpful to management as it considered different projects and decisions, only some of which were supportive of the company's actual position on the matrix. Effects of position As a company undertakes different combinations of product and process, management problems change. It is the interaction between these two that deter- mines which tasks will be critical for a given com- pany or industry. Along the process structure dimen- sion, for example, the key competitive advantage of a jumbled flow operation is its flexibility to both product and volume changes. As one moves toward more standardized processes, the competitive em- phasis generally shifts from flexibility and quality (measured in terms of product specialization) to reli- ability, predictability, and cost. A similar sequence of competitive emphases occurs as a company moves along the product structure dimension. These move- ments in priorities are illustrated in Exhibit II. For a given product structure, a company whose competitive emphasis is on quality or new product development would choose a much more flexible production operation than would a competitor who has the same product structure but who follows a cost-minimizing strategy. Alternatively, a company that chooses a given process structure reinforces the characteristics of that structure by adopting the cor- responding product structure. The former approach positions the company above the diagonal, while the latter positions it somewhere along it. A company's location on the matrix should take into account its traditional orientation. Many com- panies tend to be relatively aggressive along the di- mension-product or process-where they feel most competent and take the other dimension as "given" by the industry and environment. For example, a marketing-oriented company seeking to be respon- sive to the needs of a given market is more likely to emphasize flexibility and quality than the manufac- turing-oriented company that seeks to mold the mar- ket to its cost or process leadership. An example of these two competitive approaches in the electric motor industry is provided by the contrast between Reliance Electric and Emerson Electric. Reliance, on the one hand, has apparently chosen production processes that place it above the diagonal for a given product and market, and the company emphasizes product customizing and per- formance. Emerson, on the other hand, tends to posi- tion itself below the diagonal and emphasizes cost reduction. As a result of this difference in emphasis, the majority of Reliance's products are in the upper left quadrant, while Emerson's products tend to be in the lower right quadrant. Even where the two com- panies' product lines overlap, Reliance is likely to use a more fluid process for that product, while Emerson is more likely to use a standardized process. Each company has sought to develop a set of com- petitive skills in manufacturing and marketing that will make it more effective within its selected quad- rants. Concentrating on the upper left versus the lower right quadrant has many additional implications for a company. The management that chooses to com- pete primarily in the upper left has to decide when to drop or abandon a product or market, while for the management choosing to compete in the lower right a major decision is when to enter the market. In the latter case, the company can watch the market de- velop and does not have as much need for flexibility as do companies that position themselves in the upper left, since product and market changes typi- cally occur less frequently during the later phases of the product life cycle. Such thinking about both product and process ex- pertise is particularly useful in selecting the match of these two dimensions for a new product. Those famil- iar with the digital watch industry may recall that in the early 1970s Texas Instruments introduced a jew- elry line digital watch. This product represented a matrix combination in the upper left-hand quadrant, as shown in Exhibit II. Unfortunately, this line of watches was disappointing to Texas Instruments, in terms of both volume and profitability. Early in 1976, therefore, TI introduced a digital watch selling for $19.95. With only one electronic module and a con- nected line flow production process, this watch rep- resented a combination of product and process fur- ther down the diagonal and much more in keeping with TI's traditional strengths and emphases. Organizing operations If management considers the process structure di- mension of organizational competence and strategy, it can usually focus its operating units much more effectively on their individual tasks. For example, many companies face the problem of how to organize production of spare parts for their primary products. While increasing volume of the primary products may have caused the company to move down the diagonal, the follow-on demand for spare parts may require a combination of product and process struc- tures more toward the upper left-hand corner of the matrix. There are many more items to be manufac- tured, each in smaller volume, and the appropriate process tends to be more flexible than may be the case for the primary product. To accommodate the specific requirements of spare parts production, a company might develop a separate facility for them or simply separate their production within the same facility. Probably the least appropri- ate approach is to leave such production undifferen- tiated from the production of the basic product, since this would require the plant to span too broad a range of both product and process, making it less efficient and less effective for both categories of product. The choice of product and process structures will determine the kind of manufacturing problems that will be important for management. Some of the key tasks related to a particular process structure are indicated on the right side of Exhibit II. Recognizing the impact that the company's position on the matrix has on these important tasks will often suggest changes in various aspects of the policies and proce- dures the company uses in managing its manufactur- ing function, particularly in its manufacturing con- trol system. Also, measures used to monitor and evaluate the company's manufacturing performance must reflect the matrix position selected if such measures are to be both useful and consistent with the corporate goals and strategy. Such a task-oriented analysis might help a com- pany avoid the loss of control over manufacturing that often results when a standard set of control mechanisms is applied to all products and processes. It also suggests the need for different types of man- agement skills (and managers), depending on the company's major manufacturing tasks and dominant competitive modes. While a fairly narrow focus may be required for success in any single product market, companies that are large enough can (and do) effectively produce multiple products in multiple markets. These are often in different stages of the product life cycle. However, for such an operation to be successful, a company must separate and organize its manufactur- ing facilities to best meet the needs of each product and then develop sales volumes that are large enough to make those manufacturing units competitive. An example of separating a company's total manu- facturing capability into specialized units is provided by the Lynchburg Foundry, a wholly owned subsidi- ary of the Mead Corporation. This foundry has five plants in Virginia. As Exhibit II shows, these plants represent different positions on the matrix. One plant is a job shop, making mostly one-of-a-kind products. Two plants use a decoupled batch process and make several major products. A fourth plant is a paced assembly line operation that makes only a few prod- ucts, mainly for the automative market. The fifth plant is a highly automated pipe plant, making what is largely a commodity item. While the basic technology is somewhat different in each plant, there are many similarities. However, the production layout, the manufacturing processes, and the control systems are very different. This com- pany chose to design its plants so that each would meet the needs of a specific segment of the market in the most competitive manner. Its success would sug- gest that this has been an effective way to match manufacturing capabilities with market demand. Companies that specialize their operating units according to the needs of specific, narrowly defined patches on the matrix will often encounter problems in integrating those units into a coordinated whole. A recent article suggested that a company can be most successful by organizing its manufacturing function around either a product-market focus or a process focus. That is, individual units will either manage themselves relatively autonomously, re- sponding directly to the needs of the markets they serve, or they will be divided according to process stages (for example, fabrication, subassembly, and final assembly), all coordinated by a central staff. Companies in the major materials industries- steel companies and oil companies, for example- provide classic examples of process-organized manu- facturing organizations. Most companies that broaden the span of their process through vertical integration tend to adopt such an organzation, at least initially. Then again, companies that adopt a product- or market-oriented organization in manufacturing tend to have a strong market orientation and are unwilling to accept the organizational rigidity and lengthened response time that usually accompany centralized coordination. Most companies in the packaging industry provide examples of such product- and market-focused manu- facturing organizations. Regional plants that serve geographical market areas are set up to reduce trans- portation costs and provide better response to market requirements. A number of companies that historically have or- ganized themselves around products or markets have found that, as their products matured and as they have moved to become more vertically integrated, a conflict has arisen between their original product- organized manufacturing facilities and the needs of their process-oriented internal supply units. As the competitive emphasis has shifted toward cost, companies moving along the diagonal have tended to evolve from a product-oriented manufac- turing organization to a process-oriented one. How- ever, at some point, such companies often discover that their operations have become so complex with increased volume and increased stages of in-house production that they defy centralized coordination and management must revert to a more product- oriented organization within a divisionalized struc- ture. STRATEGY IMPLICATIONS We can now pull together a number of threads and summarize their implications for corporate strategy. Companies must make a series of interrelated mar- keting and manufacturing decisions. These choices must be continually reviewed and sometimes changed as the company's products and competitors evolve and mature. A company may choose a product or marketing strategy that gives it a broader or nar- rower product line than its principal competitors. Such a choice positions it to the left or right of its competitors, along the horizontal dimension of our matrix. Having made this decision, the company has a further choice to make: Should it produce this prod- uct line with a manufacturing system-a set of peo- ple, plants, equipment, technology, policies, and con- trol procedures that will permit a relatively high degree of flexibility and a relatively low capital inten- sity? Or should it prefer a system that will permit lower cost production with a loss of some flexibility to change (in products, production volumes, and equipment) and usually a higher degree of capital intensity? This choice will position the company above or below its competitors along the vertical dimension of our matrix. There are, of course, several dynamic aspects of corporate competitiveness where the concepts of matching the product life cycle with the process life cycle can be applied. In this article, however, we have dealt only with the more static aspects of selecting a position on the matrix. We will discuss in a forthcom- ing article how a company's position on the product- process matrix might change over time and the traps that it can fall into if the implications of such moves are not carefully evaluated. 1. The Product Life Cycle and International Trade, Louis T. Wells, Jr., ed. (Cambridge, Mass.: Harvard University Press, 1972), for example, provides evidence from a number of industries that argues for broad application of this concept. 2. N.K. Dhalla and S. Yuspeh, "Forget the Product Life Concept!" HBR January-February 1976, p. 102. 3. For example, William J. Abernathy and Philip L. Townsend, "Technology, Productivity, and Process Changes," in Technologi- cal Forecasting and Social Change, Volume VII, No. 4, 1975, p. 379; Abernathy and James Utterback, "Dynamic Model of Process and Product Innovation," Omega, Volume III, No. 6, 1975, p. 639; Abernathy and Utterback, "Innovation and the Evolution of Tech- nology in the Firm," Harvard Business School Working Paper (HBS 75-18R, Revised June 1975). 4. See "Manufacturing-Missing Link in Corporate Strategy," by Wickham Skinner, HBR May-June 1969, p. 136. 5. "The Focused Factory," HBR May-June 1974, p. 113. 6. Robert H. Hayes and Roger W. Schmenner, "How Should You Organize Manufacturing?" HBR January-February 1978, p. 105. EXHIBIT II Expanded product-process matrix Product structure Product life cycle stage I Low volume - low standardization, one of a kind Process structure Process life cycle stage I Jumbled flow (job shop) || Disconnected line flow (batch) Connected line flow (assembly line) IV Continuous flow Dominant competitive mode || Multiple products low volume TI old watch Lynchburg #1 None Flexibility-quality Custom design General purpose High margins Lynchburg # 2 and #3 Custom design Quality control Service High margins Few major products higher volume Lynchburg, #4 Standardized design Volume manufacturing Finished goods inventory Distribution Backup suppliers IV High volume - high standardization, commodity products None TI new watchi Lynchburg #5 Dependability cost Vertical integration Long runs Specialized equipment and processes Economies of scale Standardized material Flexibility- quality Dependability - cost Key management tasks Fast reaction Loading plant, estimating capacity Estimating costs and delivery times Breaking bottlenecks Order tracing and expediting Systematizing diverse elements Developing standards and methods, improvement Balancing process stages Managing large, specialized, and complex operations Meeting material requirements Running equipment at peak efficiency Timing expansion and technological change Raising required capital EXHIBITI Matching major stages of product and process life cycles Product structure Product life cycle stage 1 || Low volume - low Multiple products low volume standardization, one of a kind Process structure Process life cycle stage Jumbled flow (job shop) || Disconnected line flow (batch) III Connected line flow (assembly line) IV Continuous flow Commercial printer None Heavy equipment Few major products higher volume Automobile assembly IV High volume - high standardization, commodity products None Sugar refinery