Question: Please supply correct answer 10. Mary is a 65 widow who has the following sources of income in 2015: Capital years old gains S4,000. Bank

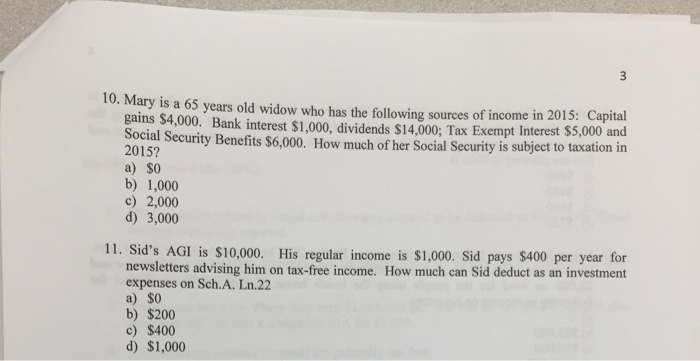

10. Mary is a 65 widow who has the following sources of income in 2015: Capital years old gains S4,000. Bank interest $1,000, dividends $14,000; Tax Exempt Interest $5,000 and Social Security Benefits s6,000. How much of her Social Security is subject to taxation in a) $0 b) 1,000 c) 2,000 d 3,000 11. Sid's AGI is $10,000. His regular income is $1,000 Sid pays $400 per year for newsletters advising him on tax-free income. How much can Sid deduct as an investment expenses on Sch A. Ln.22 a) b) $200 c) $400 d) $1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts