Question: Please teach me how to get Direct Labour Buget Manufacturing Overhead Budget Ending Finished Goods Inventory - Budgeted at April 30, 2018 (variable costing Waverly

Please teach me how to get

Please teach me how to get

- Direct Labour Buget

- Manufacturing Overhead Budget

- Ending Finished Goods Inventory - Budgeted at April 30, 2018 (variable costing

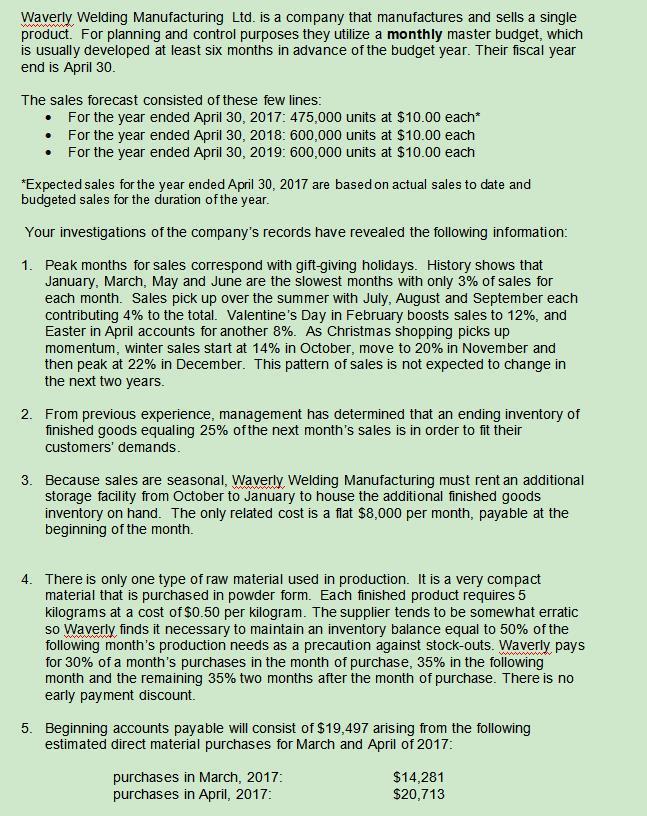

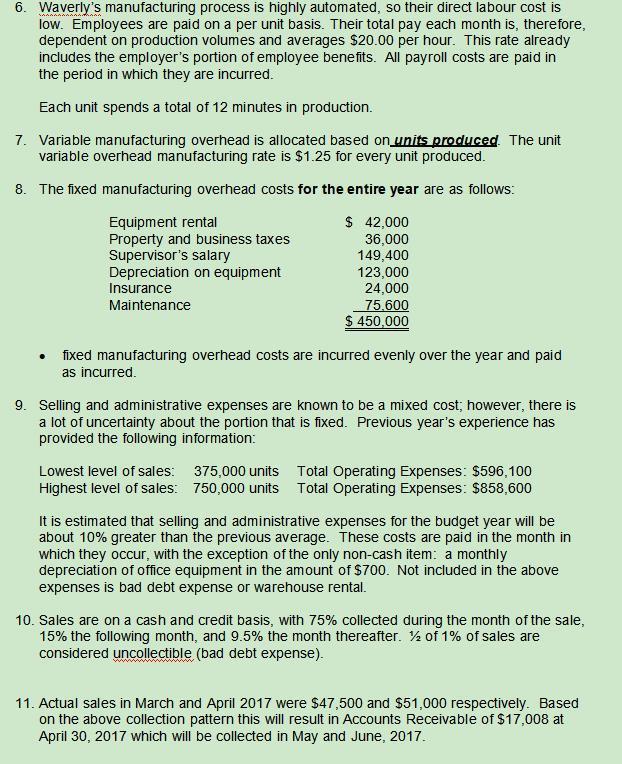

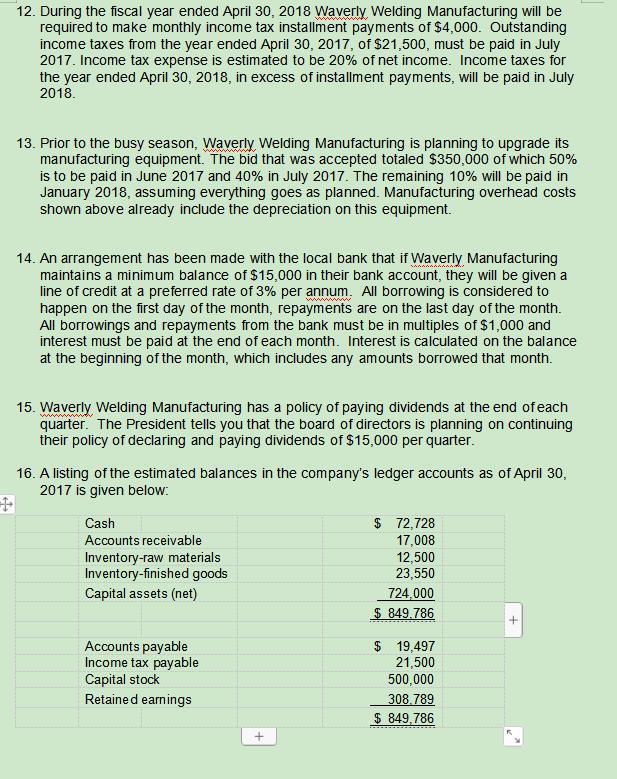

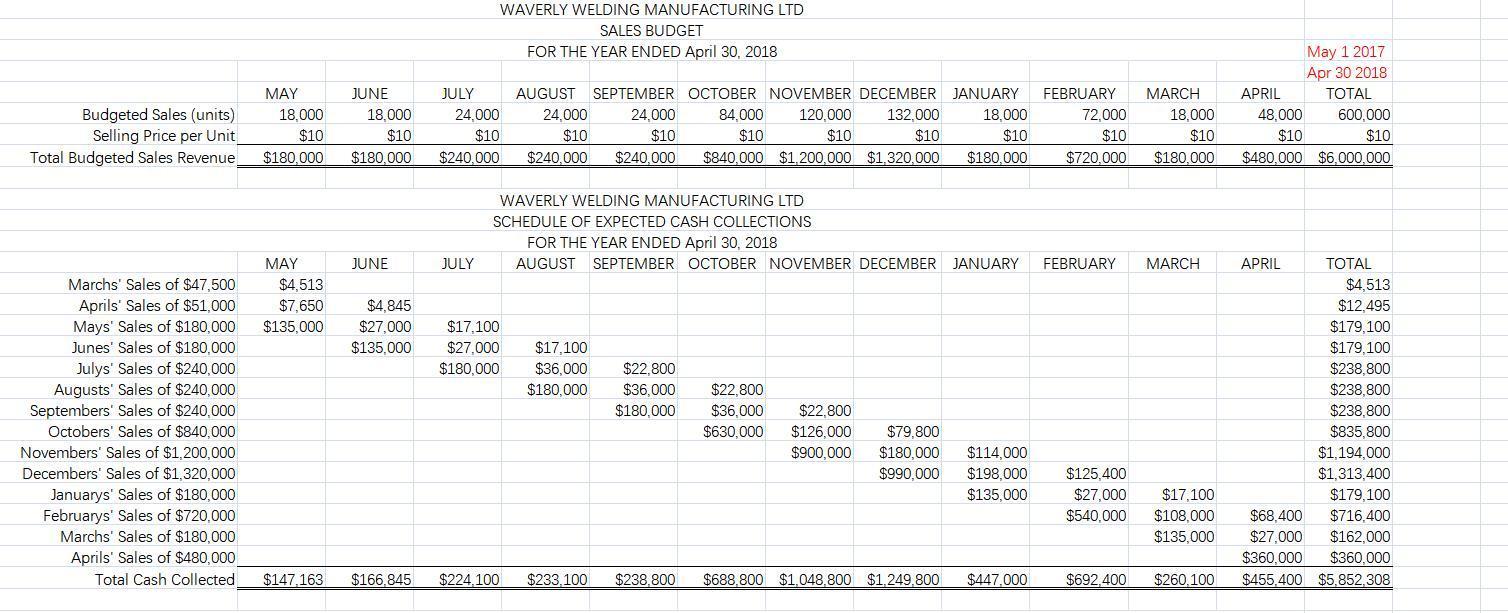

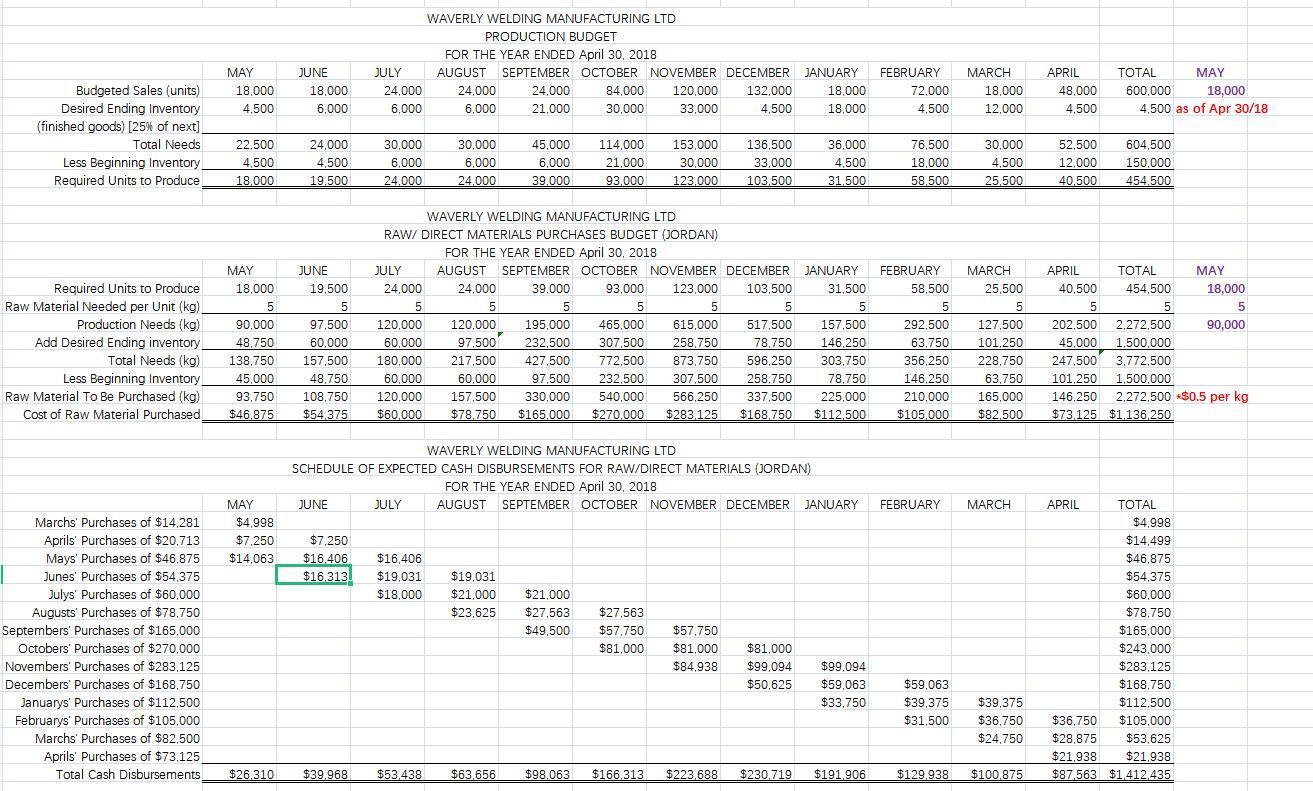

Waverly Welding Manufacturing Ltd. is a company that manufactures and sells a single product. For planning and control purposes they utilize a monthly master budget, which is usually developed at least six months in advance of the budget year. Their fiscal year end is April 30. The sales forecast consisted of these few lines: . For the year ended April 30, 2017: 475,000 units at $10.00 each* For the year ended April 30, 2018: 600,000 units at $10.00 each For the year ended April 30, 2019: 600,000 units at $10.00 each *Expected sales for the year ended April 30, 2017 are based on actual sales to date and budgeted sales for the duration of the year. Your investigations of the company's records have revealed the following information: 1. Peak months for sales correspond with gift-giving holidays. History shows that January, March, May and June are the slowest months with only 3% of sales for each month. Sales pick up over the summer with July, August and September each contributing 4% to the total. Valentine's Day in February boosts sales to 12%, and Easter in April accounts for another 8%. As Christmas shopping picks up momentum, winter sales start at 14% in October, move to 20% in November and then peak at 22% in December. This pattern of sales is not expected to change in the next two years. 2. From previous experience, management has determined that an ending inventory of finished goods equaling 25% of the next month's sales is in order to fit their customers' demands. 3. Because sales are seasonal, Waverly, Welding Manufacturing must rent an additional storage facility from October to January to house the additional finished goods inventory on hand. The only related cost is a flat $8,000 per month, payable at the beginning of the month. 4. There is only one type of raw material used in production. It is a very compact material that is purchased in powder form. Each finished product requires 5 kilograms at a cost of $0.50 per kilogram. The supplier tends to be somewhat erratic so Waverly finds it necessary to maintain an inventory balance equal to 50% of the following month's production needs as a precaution against stock-outs. Waverly pays for 30% of a month's purchases in the month of purchase, 35% in the following month and the remaining 35% two months after the month of purchase. There is no early payment discount. 5. Beginning accounts payable will consist of $19,497 arising from the following estimated direct material purchases for March and April of 2017: purchases in March, 2017: purchases in April, 2017: $14,281 $20,713

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

1 Sales Budget Percentage Sale Expected sale in units Sellign price per unit Total Sales 1a Cash Col... View full answer

Get step-by-step solutions from verified subject matter experts