Question: Please teach me how to solve using the BA II Plus calculator if possible. Capltal Budgeting Narrative (Use the following information for questions referring to

Please teach me how to solve using the BA II Plus calculator if possible.

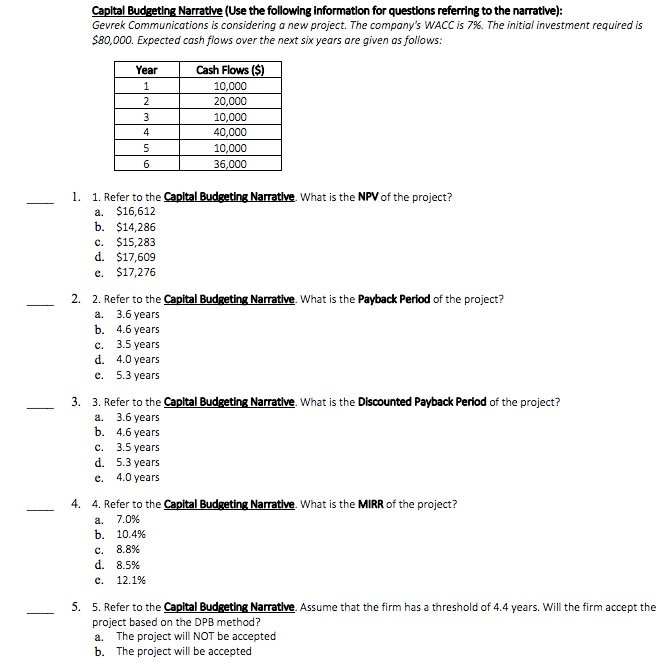

Capltal Budgeting Narrative (Use the following information for questions referring to the narratlve): Gevrek Communications is considering a new project. The company's WACC is 7%. The initial investment required is $80,000. Expected cash fiows over the next six years are given as follows: Cash Flows 10,000 20,000 10,000 40,000 10,000 36,000 Year 1. 1. Refer to the Capital Budgeting Narrative. What is the NPV of the project? a. $16,612 b. $14,286 c. $15,283 d. $17,609 e. $17,276 2. 2. Refer to the Capital Budgeting Narrative. What is the Payback Period of the project? a. 3.6 years b. 4.6 years c. 3.5 years d. 4.0 years e. 5.3 years 3. 3. Refer to the Capital Budgeting Narrative. What is the Discounted Payback Period of the project? a. 3.6 years b. 4.6 years C. 3.5 years d. 5.3 years e. 4.0 years 4. 4. Refer to the Capital Budgeting Narrative. What is the MIRR of the project? a. b. c. d. e. 7.0% 10.4% 8.8% 8.5% 12.1% 5. 5. Refer to the Capital Budgeting Narrative. Assume that the firm has a threshold of 4.4 years. Will the firm accept the project based on the DPB method? a. The project will NOT be accepted b. The project will be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts