Question: please this my second time to send this Q please i need help Blue Angel, Inc., a private firm in the holiday gift industry, is

please this my second time to send this Q please i need help

please this my second time to send this Q please i need help

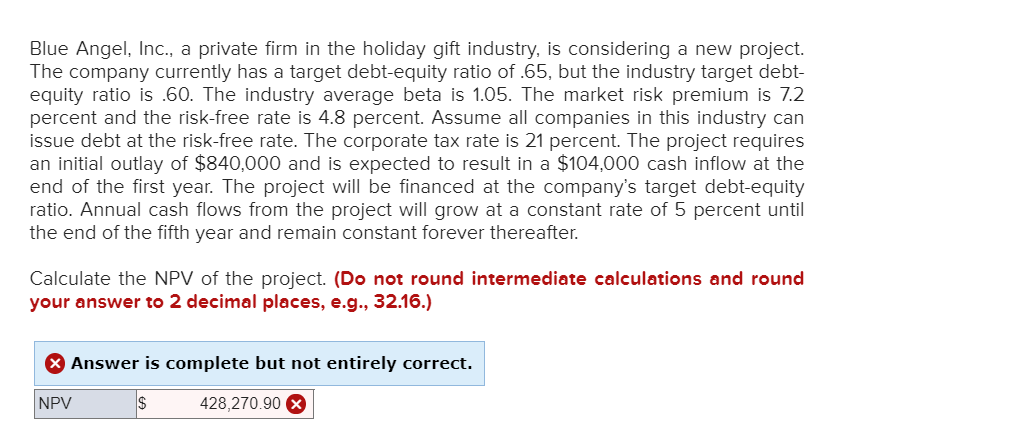

Blue Angel, Inc., a private firm in the holiday gift industry, is considering a new project. The company currently has a target debt-equity ratio of.65, but the industry target debt- equity ratio is .60. The industry average beta is 1.05. The market risk premium is 7.2 percent and the risk-free rate is 4.8 percent. Assume all companies in this industry can issue debt at the risk-free rate. The corporate tax rate is 21 percent. The project requires an initial outlay of $840,000 and is expected to result in a $104,000 cash inflow at the end of the first year. The project will be financed at the company's target debt-equity ratio. Annual cash flows from the project will grow at a constant rate of 5 percent until the end of the fifth year and remain constant forever thereafter. Calculate the NPV of the project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) X Answer is complete but not entirely correct. NPV $ 428,270.90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts