Question: Problem 1. (40 Points) Today the $/ spot exchange rate Es/y is $0.0135 per Japanese yen, the 3-month forward exchange rate Fs/ is $0.0118 per

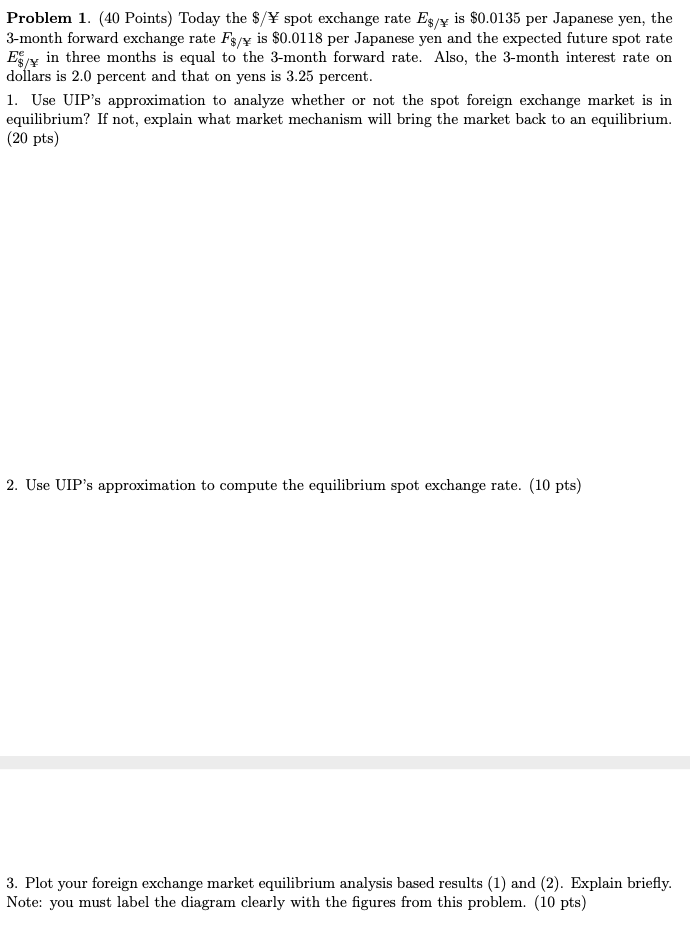

Problem 1. (40 Points) Today the $/ spot exchange rate Es/y is $0.0135 per Japanese yen, the 3-month forward exchange rate Fs/ is $0.0118 per Japanese yen and the expected future spot rate Ey in three months is equal to the 3-month forward rate. Also, the 3-month interest rate on dollars is 2.0 percent and that on yens is 3.25 percent. 1. Use UIP's approximation to analyze whether or not the spot foreign exchange market is in equilibrium? If not, explain what market mechanism will bring the market back to an equilibrium. (20 pts) 2. Use UIP's approximation to compute the equilibrium spot exchange rate. (10 pts) 3. Plot your foreign exchange market equilibrium analysis based results (1) and (2). Explain briefly. Note: you must label the diagram clearly with the figures from this problem. (10 pts) Problem 1. (40 Points) Today the $/ spot exchange rate Es/y is $0.0135 per Japanese yen, the 3-month forward exchange rate Fs/ is $0.0118 per Japanese yen and the expected future spot rate Ey in three months is equal to the 3-month forward rate. Also, the 3-month interest rate on dollars is 2.0 percent and that on yens is 3.25 percent. 1. Use UIP's approximation to analyze whether or not the spot foreign exchange market is in equilibrium? If not, explain what market mechanism will bring the market back to an equilibrium. (20 pts) 2. Use UIP's approximation to compute the equilibrium spot exchange rate. (10 pts) 3. Plot your foreign exchange market equilibrium analysis based results (1) and (2). Explain briefly. Note: you must label the diagram clearly with the figures from this problem. (10 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts