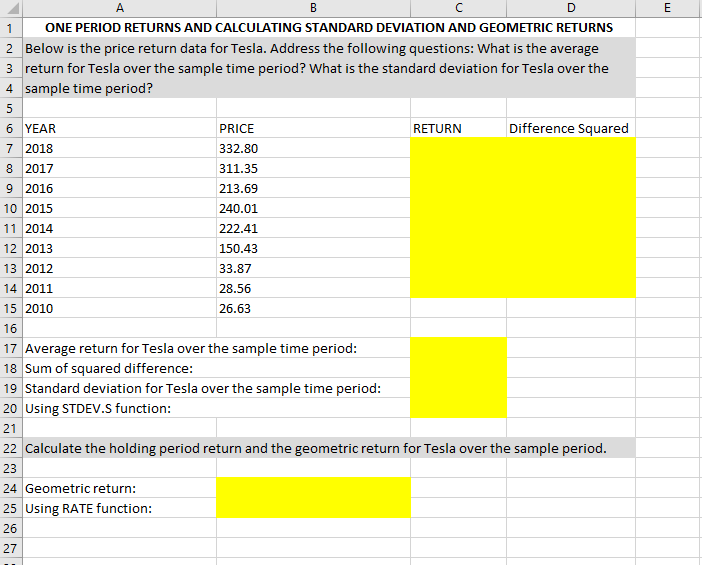

Question: Please thoroughly explain the formulas used in order to get the following answers for each of the yellow highlighted areas. I am specifically looking for

Please thoroughly explain the formulas used in order to get the following answers for each of the yellow highlighted areas. I am specifically looking for the formulas used in order to get (D7:D15) and C18, C19, C20

A B C D E ONE PERIOD RETURNS AND CALCULATING STANDARD DEVIATION AND GEOMETRIC RETURNS N Below is the price return data for Tesla. Address the following questions: What is the average 3 return for Tesla over the sample time period? What is the standard deviation for Tesla over the sample time period? YEAR PRICE RETURN Difference Squared 7 2018 332.80 8 2017 311.35 9 2016 213.69 10 2015 240.01 11 2014 222.41 12 2013 150.43 13 2012 33.87 14 2011 28.56 15 2010 26.63 16 17 Average return for Tesla over the sample time period: 18 Sum of squared difference: 19 Standard deviation for Tesla over the sample time period: 20 Using STDEV.S function: 21 22 Calculate the holding period return and the geometric return for Tesla over the sample period. 23 24 Geometric return: 25 Using RATE function: 26 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts