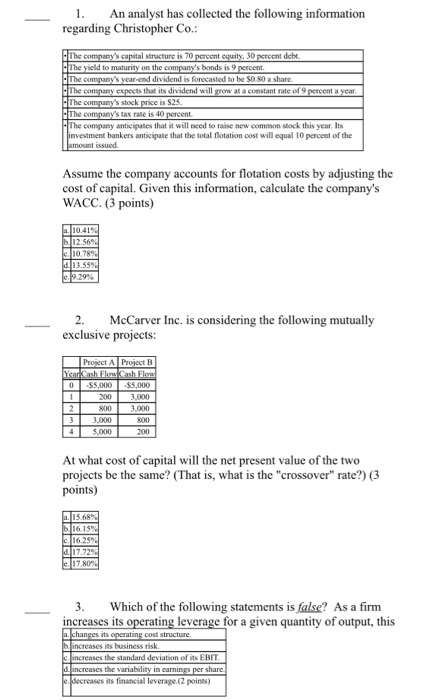

Question: please thoroughly explain with step by step directions! thank you 1. An analyst has collected the following information regarding Christopher Co.: The company's capital structure

1. An analyst has collected the following information regarding Christopher Co.: The company's capital structure is 70 percent c ity, 30 percent dcbe The yield to maturity on the company's bonds is 9 percent The company's year and dividend is forecasted to be a share The company expect that is dividend will grow at a constantmate 9 percent a year The company's stock price is $25 he company's tax rate is 40 percent The company anticipates that it will need to com e ck this year investment banks anticipate that the location cost illegal 10 percent of the Assume the company accounts for flotation costs by adjusting the cost of capital. Given this information, calculate the company's WACC. (3 points) 10.419 1256 13.559 2. McCarver Inc. is considering the following mutually exclusive projects: O Project A Project B Year Cash Flow Cash Flow S5,000 $5,000 1 200 000 900 3.000 2 At what cost of capital will the net present value of the two projects be the same? (That is, what is the "crossover" rate?) (3 points) 15.689 16.159 16.359 917.7290 17. 3. Which of the following statements is false? As a firm increases its operating leverage for a given quantity of output, this changes its operating cost structure increases in business risk reases the standard deviati EBIT Increases the variability in earnings per share decreases its financial leverage (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts