Question: Please to whoever solves this: This a test correction, I failed the test and i need to show complete and clear work so i can

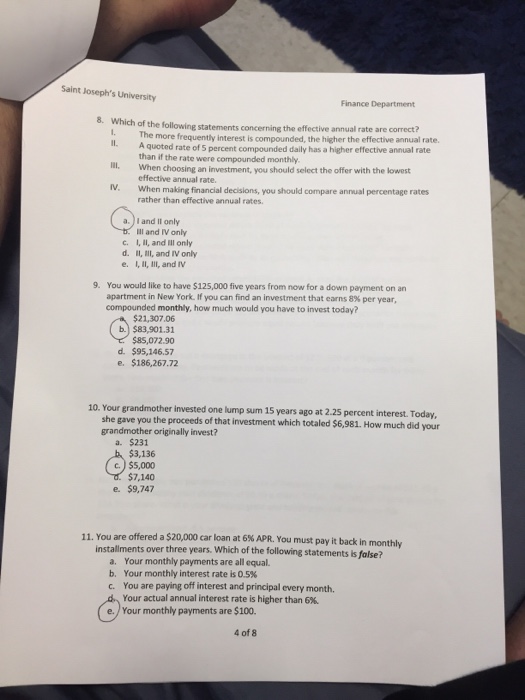

Saint Joseph's University Finance Department 8. of the following statements concerning the effective annual rate are correct? The more frequently interest is compounded, the higher the effective annual rate. A quoted rate of 5 percent compounded daily has a higher effective annual rate than if the rate were compounded monthly. . Whenhooing an investmett the offer with the bowest IV. When making financial decisions, you should compare annual percentage rates effective annual rate rather than effective annual rates. a.) I and Il only Ill and IV only c. I, II, and ill only d. I, Ill, and IV only e. I, II, I, and IV You would like to have $125,000 five years from now for a down apartment in New York. If you can find an investment that earns 8% per year compounded monthly, how much would you have to invest today? 9. payment on an $21,307.06 b.) $83,901.31 $85,072.90 d. $95,146.57 e. $186,267.72 10. Your grandmother invested one lump sum 15 years ago at 2.25 percent interest. Today, she gave you the proceeds of that investment which totaled $6,981. How much did your grandmother originally invest? a. $231 $3,136 c.) $5,000 $7,140 e. $9,747 11. You are offered a $ s over three years. Which of the following statements is false? Your monthly payments are all equal. Your monthly interest rate is 0.5% You are paying off interest and principal every month. Your actual annual interest rate is higher than 6%. installment a. b. c. e./ Your monthly payments are $100. 4 of 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts