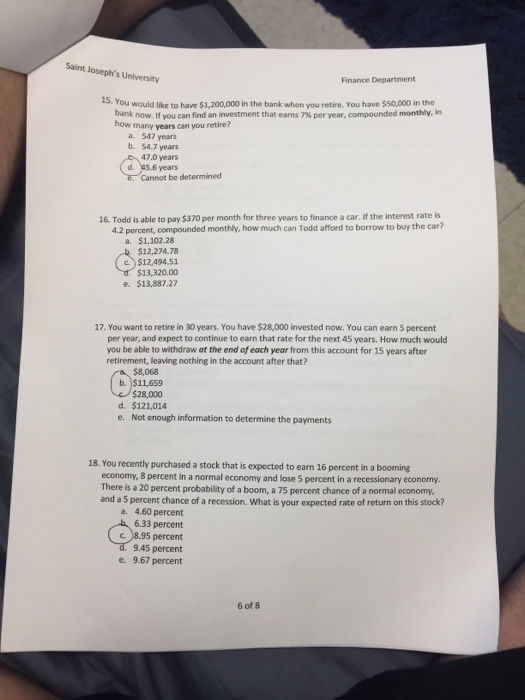

Question: Please to whoever solves this: This a test correction, I failed the test and i need to show complete and clear work so i can

Saint Joseph's University Finance Department 15. You would like to have $1,.200,000 in the bank when you retire. You have $50,000 in the bank now. If you can find an investment that earns 7% per year, compounded monthly, in how many years can you retire? a. 547 years b. 54.7 years 47.0 years d. 45.6 years Cannot be determined 16. Todd is able to pay $370 per month for three years to finance a car. if the interest rate is 4.2 percent, compounded monthly, how much can Todd afford to borrow to buy the car? a. $1,102.28 $12,274.78 c.) $12,494.51 $13,320.00 e. $13,887.27 17. You want to retire in 30 years. You have $28,000 invested now. You can earn 5 percent per year, and expect to continue to earn that rate for the next 45 years. How much would you be able to withdraw at the end of each year from this account for 15 years after retirement, leaving nothing in the account after that? $8,068 b. $11,659 d. $121,014 e. Not enough information to determine the payments 18. You recently purchased a stock that is expected to earn 16 percent in a booming economy, 8 percent in a normal economy and lose 5 percent in a recessionary economy. There is a 20 percent probability of a boom, a 75 percent chance of a normal economy and a 5 percent chance of a recession. What is your expected rate of return on this stock? a. 4.60 percent 6.33 percent c. )8.95 percent 9.45 percent e. 9.67 percent 6 of 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts