Question: please try to answer all thank you Question 2 3.34 pts VM Materials Inc. management has decided to repurchase some of the company's shares. The

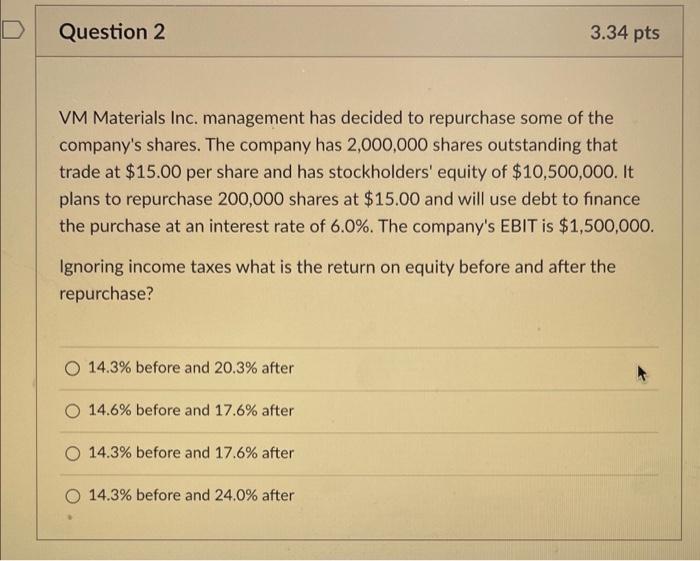

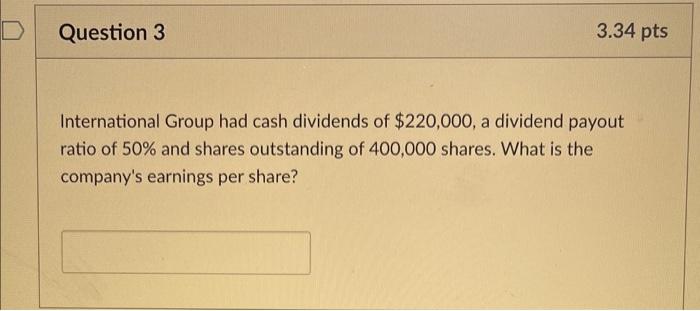

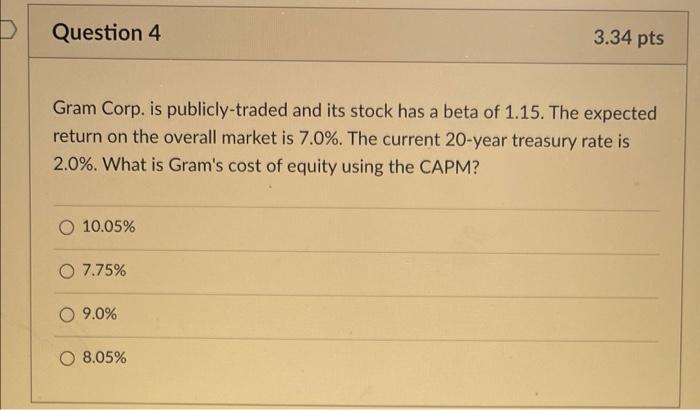

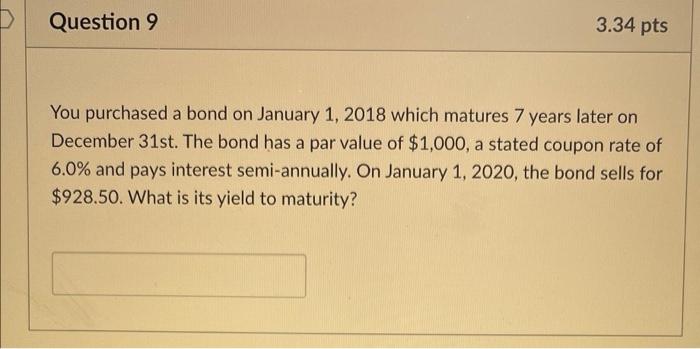

Question 2 3.34 pts VM Materials Inc. management has decided to repurchase some of the company's shares. The company has 2,000,000 shares outstanding that trade at $15.00 per share and has stockholders' equity of $10,500,000. It plans to repurchase 200,000 shares at $15.00 and will use debt to finance the purchase at an interest rate of 6.0%. The company's EBIT is $1,500,000. Ignoring income taxes what is the return on equity before and after the repurchase? 14.3% before and 20.3% after 14.6% before and 17.6% after O 14.3% before and 17.6% after 14.3% before and 24.0% after Question 3 3.34 pts International Group had cash dividends of $220,000, a dividend payout ratio of 50% and shares outstanding of 400,000 shares. What is the company's earnings per share? > Question 4 3.34 pts Gram Corp. is publicly-traded and its stock has a beta of 1.15. The expected return on the overall market is 7.0%. The current 20-year treasury rate is 2.0%. What is Gram's cost of equity using the CAPM? O 10.05% O 7.75% O 9.0% 8.05% Question 9 3.34 pts You purchased a bond on January 1, 2018 which matures 7 years later on December 31st. The bond has a par value of $1,000, a stated coupon rate of 6.0% and pays interest semi-annually. On January 1, 2020, the bond sells for $928.50. What is its yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts