Question: Please try to create a two-branch binomial tree for a stock price. Assume a 1-year option expiry. Using a volatility of 25% What is the

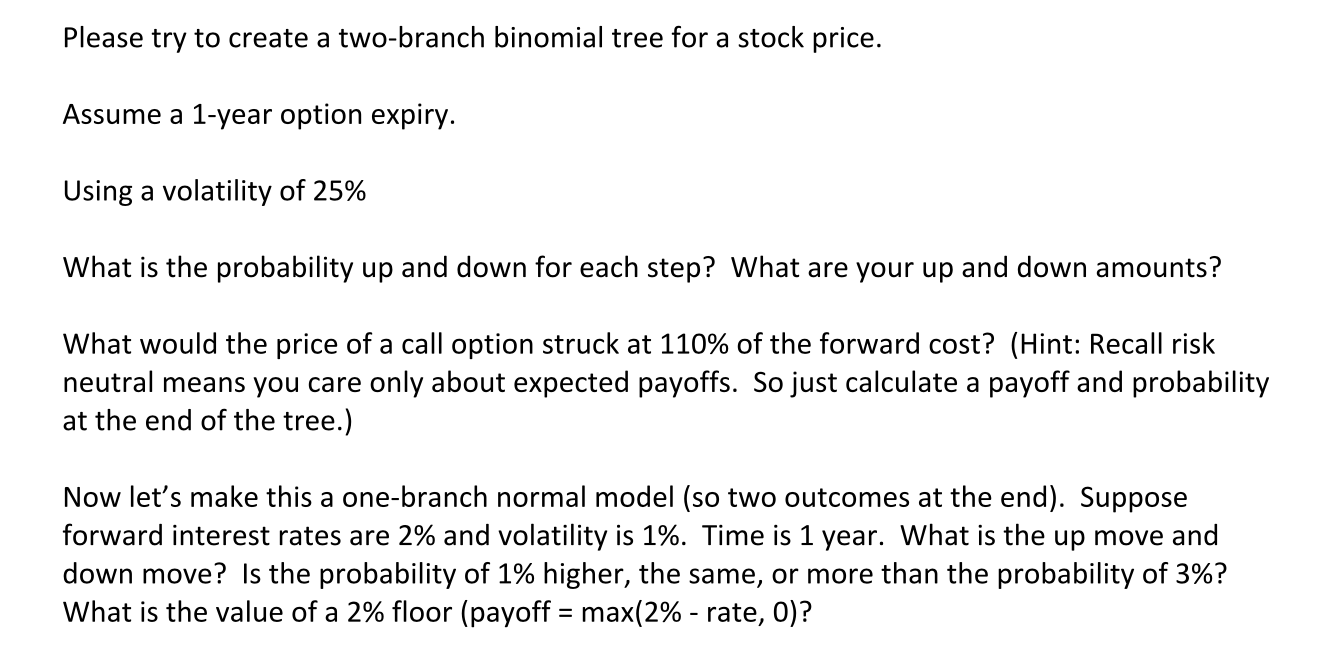

Please try to create a two-branch binomial tree for a stock price. Assume a 1-year option expiry. Using a volatility of 25% What is the probability up and down for each step? What are your up and down amounts? What would the price of a call option struck at 110% of the forward cost? (Hint: Recall risk neutral means you care only about expected payoffs. So just calculate a payoff and probability at the end of the tree.) Now let's make this a one-branch normal model (so two outcomes at the end). Suppose forward interest rates are 2% and volatility is 1%. Time is 1 year. What is the up move and down move? Is the probability of 1% higher, the same, or more than the probability of 3%? What is the value of a 2% floor (payoff = max(2% - rate, 0)? Please try to create a two-branch binomial tree for a stock price. Assume a 1-year option expiry. Using a volatility of 25% What is the probability up and down for each step? What are your up and down amounts? What would the price of a call option struck at 110% of the forward cost? (Hint: Recall risk neutral means you care only about expected payoffs. So just calculate a payoff and probability at the end of the tree.) Now let's make this a one-branch normal model (so two outcomes at the end). Suppose forward interest rates are 2% and volatility is 1%. Time is 1 year. What is the up move and down move? Is the probability of 1% higher, the same, or more than the probability of 3%? What is the value of a 2% floor (payoff = max(2% - rate, 0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts