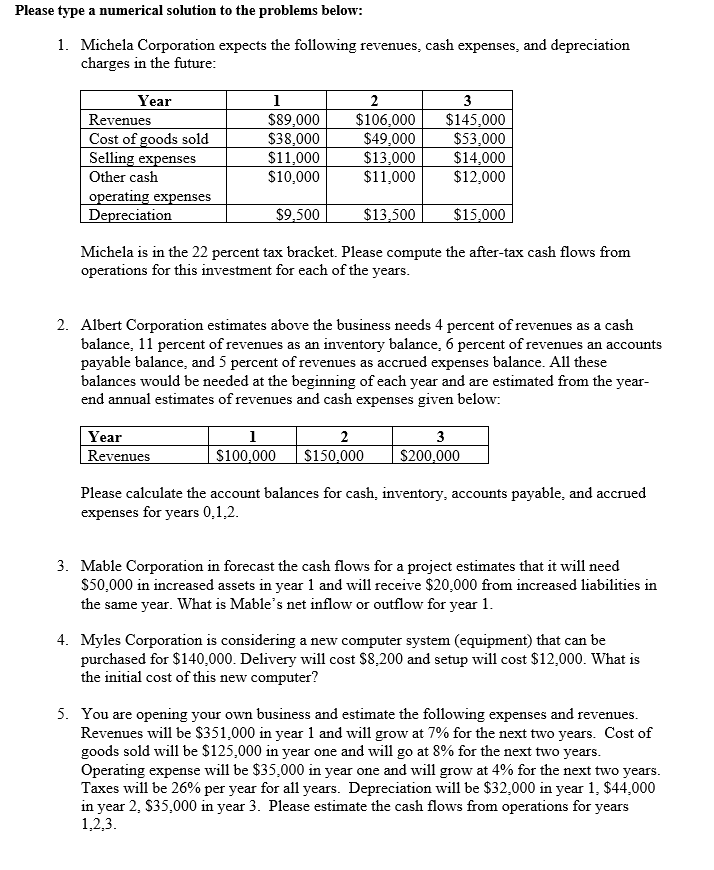

Question: Please type a numerical solution to the problems below: 1. Michela Corporation expects the following revenues, cash expenses, and depreciation charges in the future: Year

Please type a numerical solution to the problems below: 1. Michela Corporation expects the following revenues, cash expenses, and depreciation charges in the future: Year Revenues Cost of goods sold Selling expenses Other cash operating expenses Depreciation 1 $89,000 $38,000 $11,000 $10,000 2 $106,000 $49,000 $13,000 $11,000 3 $145,000 $53,000 $14,000 $12,000 $9.500 $13,500 $15.000 Michela is in the 22 percent tax bracket. Please compute the after-tax cash flows from operations for this investment for each of the years. 2. Albert Corporation estimates above the business needs 4 percent of revenues as a cash balance, 11 percent of revenues as an inventory balance, 6 percent of revenues an accounts payable balance, and 5 percent of revenues as accrued expenses balance. All these balances would be needed at the beginning of each year and are estimated from the year- end annual estimates of revenues and cash expenses given below: Year Revenues 1 $100,000 2 $150,000 3 $200,000 Please calculate the account balances for cash, inventory, accounts payable, and accrued expenses for years 0,1,2. 3. Mable Corporation in forecast the cash flows for a project estimates that it will need $50,000 in increased assets in year 1 and will receive $20,000 from increased liabilities in the same year. What is Mables net inflow or outflow for year 1. 4. Myles Corporation is considering a new computer system (equipment) that can be purchased for $140,000. Delivery will cost $8,200 and setup will cost $12,000. What is the initial cost of this new computer? 5. You are opening your own business and estimate the following expenses and revenues. Revenues will be $351,000 in year 1 and will grow at 7% for the next two years. Cost of goods sold will be $125,000 in year one and will go at 8% for the next two years. Operating expense will be $35,000 in year one and will grow at 4% for the next two years. Taxes will be 26% per year for all years. Depreciation will be $32,000 in year 1, $44.000 in year 2, S35,000 in year 3. Please estimate the cash flows from operations for years 1,2,3. Please type a numerical solution to the problems below: 1. Michela Corporation expects the following revenues, cash expenses, and depreciation charges in the future: Year Revenues Cost of goods sold Selling expenses Other cash operating expenses Depreciation 1 $89,000 $38,000 $11,000 $10,000 2 $106,000 $49,000 $13,000 $11,000 3 $145,000 $53,000 $14,000 $12,000 $9.500 $13,500 $15.000 Michela is in the 22 percent tax bracket. Please compute the after-tax cash flows from operations for this investment for each of the years. 2. Albert Corporation estimates above the business needs 4 percent of revenues as a cash balance, 11 percent of revenues as an inventory balance, 6 percent of revenues an accounts payable balance, and 5 percent of revenues as accrued expenses balance. All these balances would be needed at the beginning of each year and are estimated from the year- end annual estimates of revenues and cash expenses given below: Year Revenues 1 $100,000 2 $150,000 3 $200,000 Please calculate the account balances for cash, inventory, accounts payable, and accrued expenses for years 0,1,2. 3. Mable Corporation in forecast the cash flows for a project estimates that it will need $50,000 in increased assets in year 1 and will receive $20,000 from increased liabilities in the same year. What is Mables net inflow or outflow for year 1. 4. Myles Corporation is considering a new computer system (equipment) that can be purchased for $140,000. Delivery will cost $8,200 and setup will cost $12,000. What is the initial cost of this new computer? 5. You are opening your own business and estimate the following expenses and revenues. Revenues will be $351,000 in year 1 and will grow at 7% for the next two years. Cost of goods sold will be $125,000 in year one and will go at 8% for the next two years. Operating expense will be $35,000 in year one and will grow at 4% for the next two years. Taxes will be 26% per year for all years. Depreciation will be $32,000 in year 1, $44.000 in year 2, S35,000 in year 3. Please estimate the cash flows from operations for years 1,2,3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts