Question: please type out formulas used for the last one, not just an excel sheet. thankyou If the bond price is greater than par (the bond

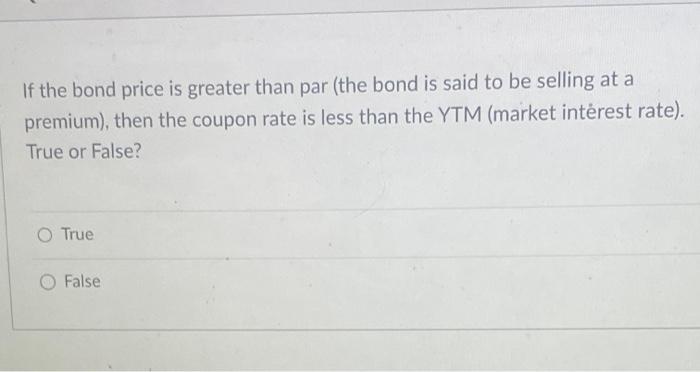

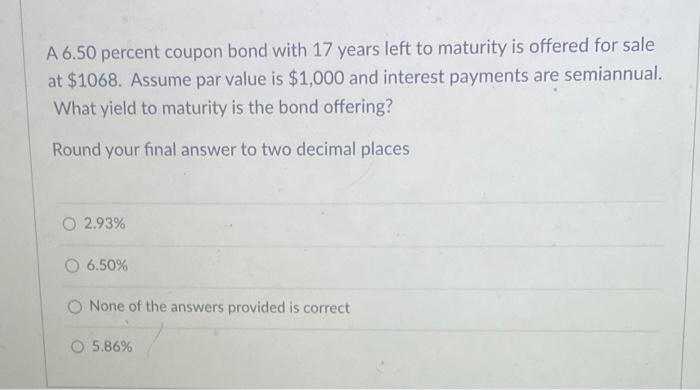

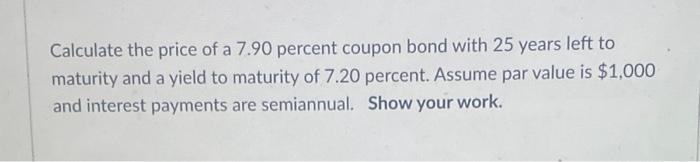

If the bond price is greater than par (the bond is said to be selling at a premium), then the coupon rate is less than the YTM (market intrest rate). True or False? True False A 6.50 percent coupon bond with 17 years left to maturity is offered for sale at $1068. Assume par value is $1,000 and interest payments are semiannual. What yield to maturity is the bond offering? Round your final answer to two decimal places 2.93% 6.50% None of the answers provided is correct 5.86% Calculate the price of a 7.90 percent coupon bond with 25 years left to maturity and a yield to maturity of 7.20 percent. Assume par value is $1,000 and interest payments are semiannual. Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts