Question: please type out formulas used, not only on an excel sheet. thankyou A 8.80 percent coupon bond matures in 20 years. It is offered for

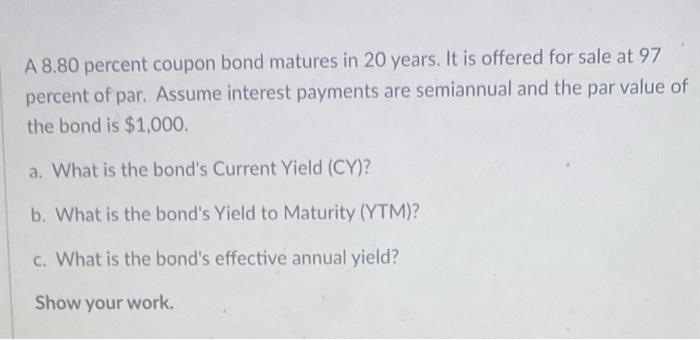

A 8.80 percent coupon bond matures in 20 years. It is offered for sale at 97 percent of par. Assume interest payments are semiannual and the par value of the bond is $1,000. a. What is the bond's Current Yield (CY)? b. What is the bond's Yield to Maturity (YTM)? c. What is the bond's effective annual yield? Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts