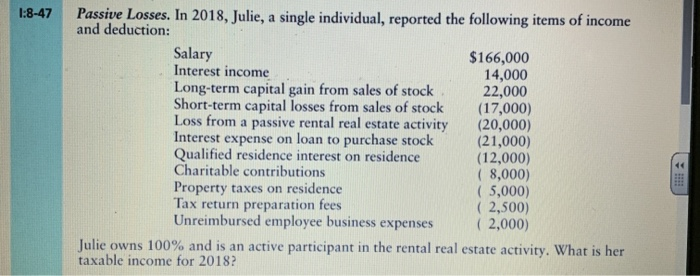

Question: please type the answer by computer dont write it by hand 1:8-47 Passive Losses. In 2018, Julie, a single individual, reported the following items of

1:8-47 Passive Losses. In 2018, Julie, a single individual, reported the following items of income and deduction: Salary $166,000 Interest income 14,000 Long-term capital gain from sales of stock 22,000 Short-term capital losses from sales of stock (17,000) Loss from a passive rental real estate activity (20,000) Interest expense on loan to purchase stock (21,000) Qualified residence interest on residence (12,000) Charitable contributions (8,000) Property taxes on residence ( 5,000) Tax return preparation fees ( 2,500) Unreimbursed employee business expenses ( 2,000) Julie owns 100% and is an active participant in the rental real estate activity. What is her taxable income for 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts