Question: Please type the answer by the computer, so i can see it clearly, thank you! Q6 (15 marks) Show All Workings At the first year

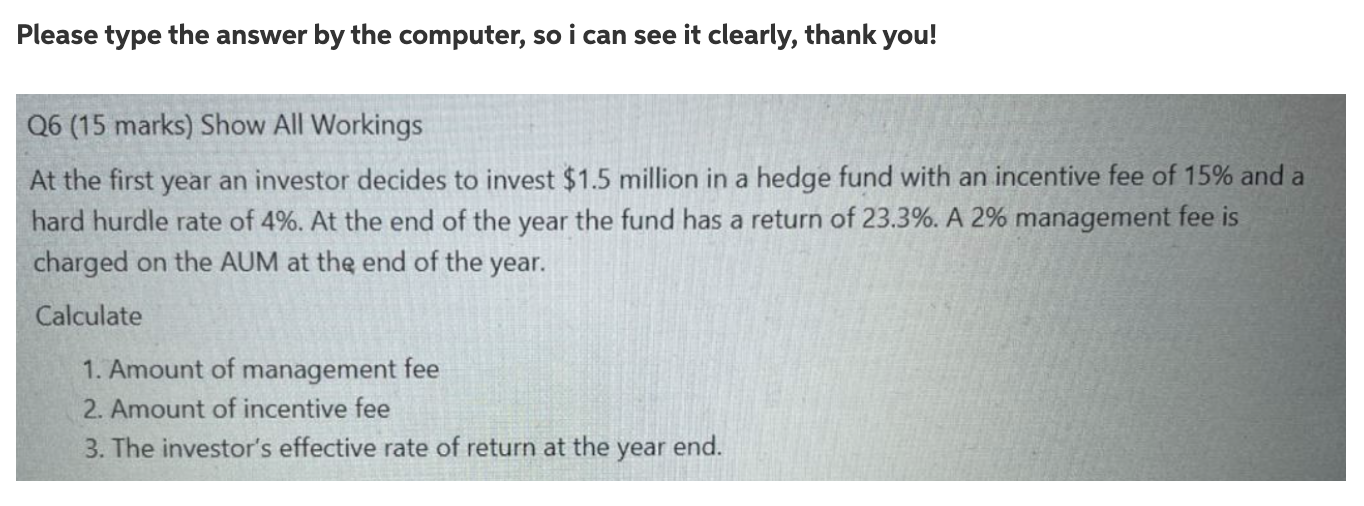

Please type the answer by the computer, so i can see it clearly, thank you! Q6 (15 marks) Show All Workings At the first year an investor decides to invest $1.5 million in a hedge fund with an incentive fee of 15% and a hard hurdle rate of 4%. At the end of the year the fund has a return of 23.3%. A 2% management fee is charged on the AUM at the end of the year. Calculate 1. Amount of management fee 2. Amount of incentive fee 3. The investor's effective rate of return at the year end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts