Question: Please type the answer by the computer, so i can see it clearly, thank you! Q5 (10 marks) Show All Workings Johnson is considering the

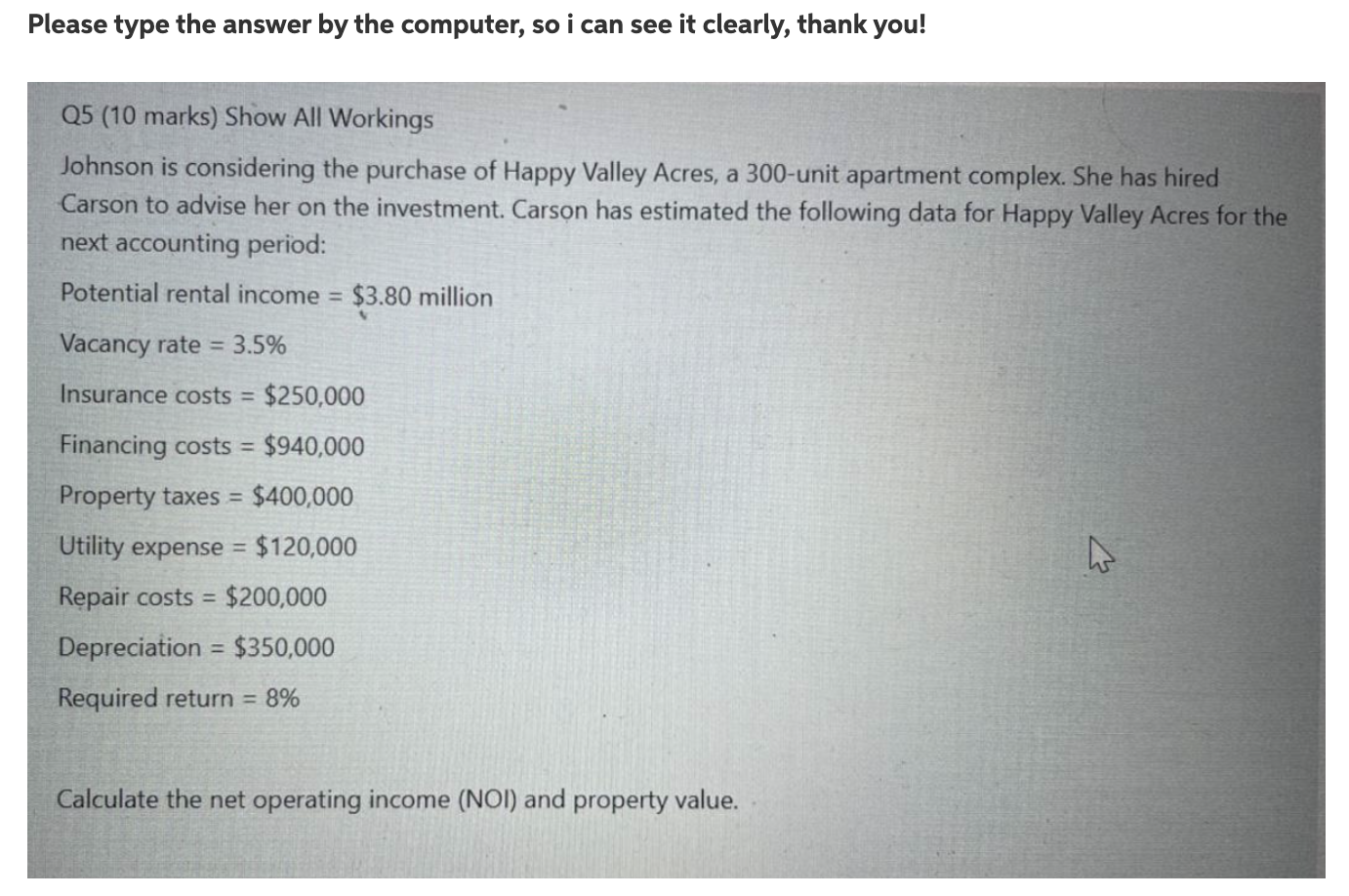

Please type the answer by the computer, so i can see it clearly, thank you! Q5 (10 marks) Show All Workings Johnson is considering the purchase of Happy Valley Acres, a 300-unit apartment complex. She has hired Carson to advise her on the investment. Carson has estimated the following data for Happy Valley Acres for the next accounting period: Potential rental income = $3.80 million Vacancy rate = 3.5% Insurance costs = $250,000 Financing costs = $940,000 Property taxes = $400,000 Utility expense = $120,000 Repair costs = $200,000 Depreciation = $350,000 Required return = 8% Calculate the net operating income (NOI) and property value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts