Question: Please type the answer by the computer, so i can see it clearly, thank you! Q3 (15 marks) Show All Workings A convertible bond (CB)

Please type the answer by the computer, so i can see it clearly, thank you!

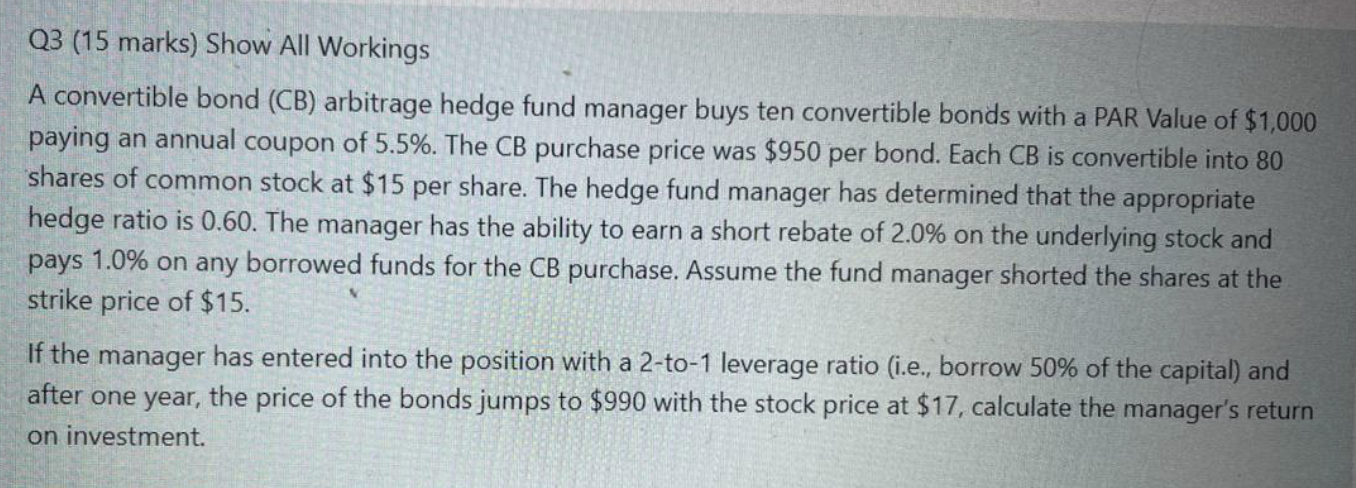

Q3 (15 marks) Show All Workings A convertible bond (CB) arbitrage hedge fund manager buys ten convertible bonds with a PAR Value of $1,000 paying an annual coupon of 5.5%. The CB purchase price was $950 per bond. Each CB is convertible into 80 shares of common stock at $15 per share. The hedge fund manager has determined that the appropriate hedge ratio is 0.60. The manager has the ability to earn a short rebate of 2.0% on the underlying stock and pays 1.0% on any borrowed funds for the CB purchase. Assume the fund manager shorted the shares at the strike price of $15. If the manager has entered into the position with a 2-to-1 leverage ratio (i.e., borrow 50% of the capital) and after one year, the price of the bonds jumps to $990 with the stock price at $17, calculate the manager's return on investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts