Question: Please type the answer form. PSA8.8 Calculate depreciation under different methods. LO4 Carpet Lid purchased machinery on 1 January 2018, at a cost of $400

Please type the answer

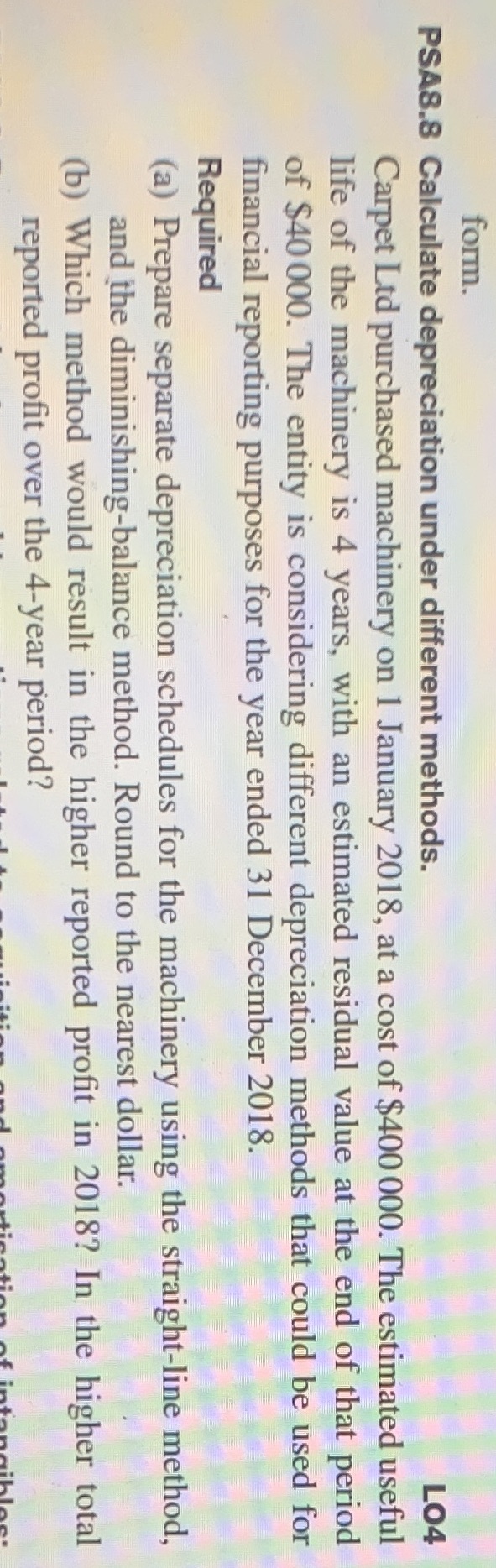

form. PSA8.8 Calculate depreciation under different methods. LO4 Carpet Lid purchased machinery on 1 January 2018, at a cost of $400 000. The estimated useful life of the machinery is 4 years, with an estimated residual value at the end of that period of $40 000. The entity is considering different depreciation methods that could be used for financial reporting purposes for the year ended 31 December 2018. Required (a) Prepare separate depreciation schedules for the machinery using the straight-line method, and the diminishing-balance method. Round to the nearest dollar. (b) Which method would result in the higher reported profit in 2018? In the higher total reported profit over the 4-year period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts