Question: Please type the answer Price-Book P/E Quick ratio Current ratio Interest coverage Debt-equity ROA% ROE% ROCE% Net margin% Tesco PLC 1.61 34.01 0.50 0.68 2.19

Please type the answer

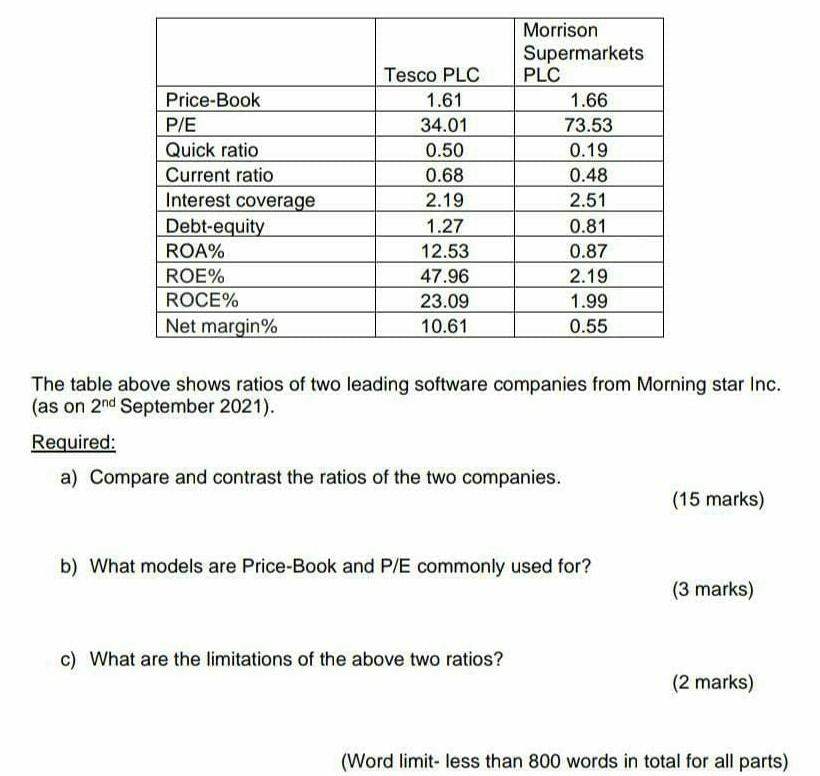

Price-Book P/E Quick ratio Current ratio Interest coverage Debt-equity ROA% ROE% ROCE% Net margin% Tesco PLC 1.61 34.01 0.50 0.68 2.19 1.27 12.53 47.96 23.09 10.61 Morrison Supermarkets PLC 1.66 73.53 0.19 0.48 2.51 0.81 0.87 2.19 1.99 0.55 The table above shows ratios of two leading software companies from Morning star Inc. (as on 2nd September 2021). Required: a) Compare and contrast the ratios of the two companies. (15 marks) b) What models are Price-Book and P/E commonly used for? (3 marks) c) What are the limitations of the above two ratios? (2 marks) (Word limit- less than 800 words in total for all parts)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock