Question: Please help me 1. (a) Tata purchased a call option on A$ for 0.02 per unit. The strike price was A$=0.45 and the spot rate

Please help me

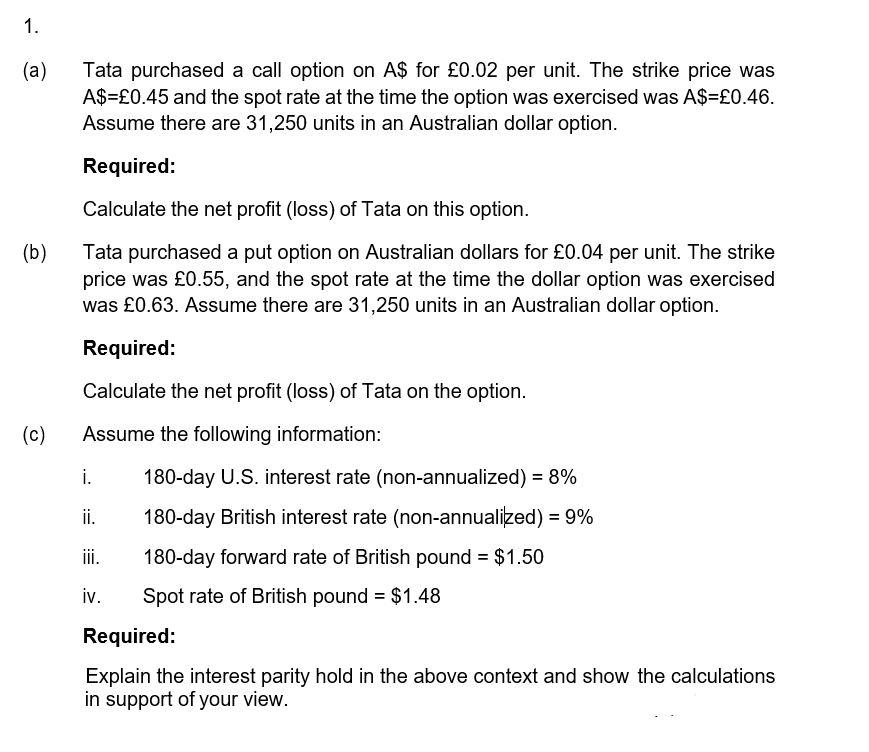

1. (a) Tata purchased a call option on A$ for 0.02 per unit. The strike price was A$=0.45 and the spot rate at the time the option was exercised was A$=0.46. Assume there are 31,250 units in an Australian dollar option. Required: Calculate the net profit (loss) of Tata on this option. (b) Tata purchased a put option on Australian dollars for 0.04 per unit. The strike price was 0.55, and the spot rate at the time the dollar option was exercised was 0.63. Assume there are 31,250 units in an Australian dollar option. Required: Calculate the net profit (loss) of Tata on the option. (c) Assume the following information: = i. 180-day U.S. interest rate (non-annualized) = 8% ii. 180-day British interest rate (non-annualized) = 9% 180-day forward rate of British pound = $1.50 iv. Spot rate of British pound = $1.48 Required: Explain the interest parity hold in the above context and show the calculations in support of your view. 1. (a) Tata purchased a call option on A$ for 0.02 per unit. The strike price was A$=0.45 and the spot rate at the time the option was exercised was A$=0.46. Assume there are 31,250 units in an Australian dollar option. Required: Calculate the net profit (loss) of Tata on this option. (b) Tata purchased a put option on Australian dollars for 0.04 per unit. The strike price was 0.55, and the spot rate at the time the dollar option was exercised was 0.63. Assume there are 31,250 units in an Australian dollar option. Required: Calculate the net profit (loss) of Tata on the option. (c) Assume the following information: = i. 180-day U.S. interest rate (non-annualized) = 8% ii. 180-day British interest rate (non-annualized) = 9% 180-day forward rate of British pound = $1.50 iv. Spot rate of British pound = $1.48 Required: Explain the interest parity hold in the above context and show the calculations in support of your view

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts