Question: please urgent. i will like work. i need it in 5 - 10 mins please. NULAT INTERVIR HACK Expand Your Critical Thinking 17-02 (Part Level

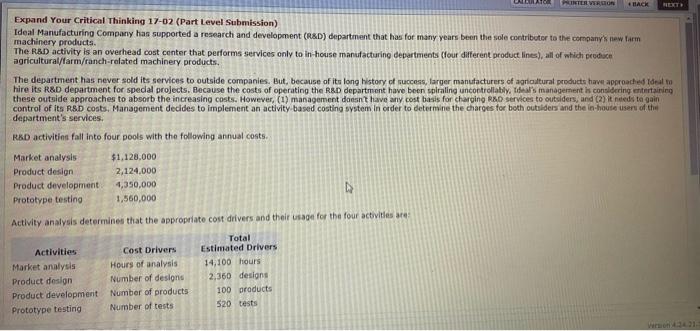

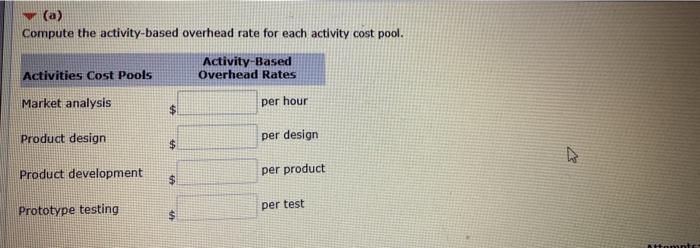

NULAT INTERVIR HACK Expand Your Critical Thinking 17-02 (Part Level Submission) Ideal Manufacturing Company has supported a research and development (R&D) department that has for many years been the sole contributor to the company's new farm machinery products. The R&D activity is an overhead cost center that performs services only to in-house manufacturing departments (four different product lines), all of which produce agricultural/farm/ranch-related machinery products, The department has never sold its services to outside companies. But, because of its long history of success, larger manufacturers of agricultural products have approached Ideal hire its R&D department for special projects. Because the costs of operating the R&D department have been spiraling uncontrollably. The's management is considering entertaining these outside approaches to absorb the increasing costs. However, (1) management doesn't have any cost basis for charging R&D services to outsiders, and (2) it needs to gain control of its RSD costs, Management decides to implement an activity based costing system in order to determine the charges for both outsiders and the in-house use of the department's services. R&D activities fall into four pools with the following annual costs. Market analysis $1,128,000 Product design 2,124.000 Product development 4,350,000 Prototype testing 1,560,000 Activity analysis determines that the appropriate cost drivers and their usage for the four activities are Activities Cost Drivers Market analysis Hours of analysis Product design Number of designs Product development Number of products Prototype testing Number of tests Total Estimated Drivers 14,100 hours 2,360 designs 100 products 520 tests (a) Compute the activity-based overhead rate for each activity cost pool. Activity-Based Overhead Rates Activities Cost Pools Market analysis per hour Product design per design Product development per product $ Prototype testing per test $ Attamnte

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts