Question: Please urgently need a solution, Help me! Blue & Gray, Inc. manufactures a line of power and hand tools for industrial and home use that

Please urgently need a solution, Help me!

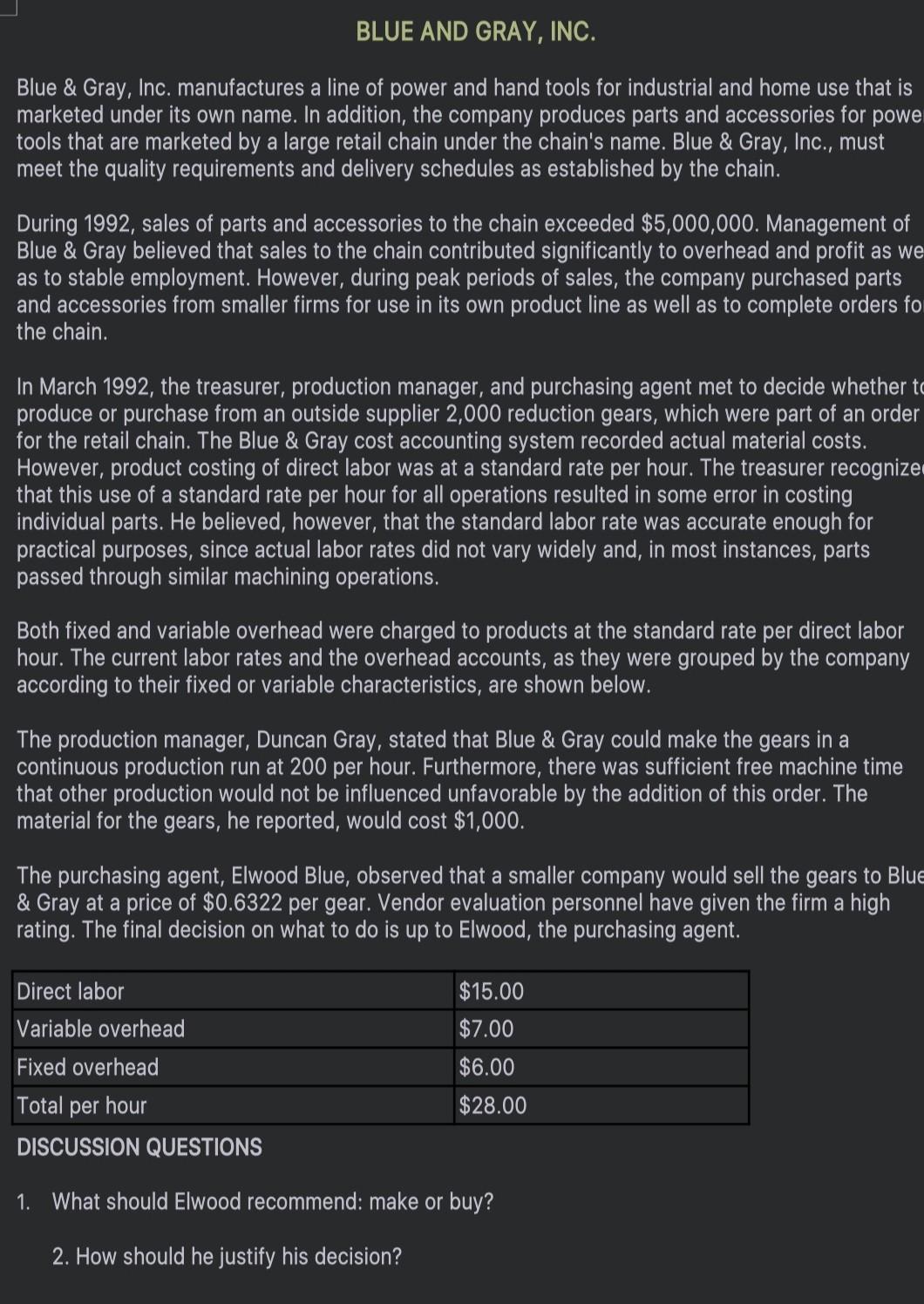

Blue \& Gray, Inc. manufactures a line of power and hand tools for industrial and home use that is marketed under its own name. In addition, the company produces parts and accessories for powe tools that are marketed by a large retail chain under the chain's name. Blue \& Gray, Inc., must meet the quality requirements and delivery schedules as established by the chain. During 1992, sales of parts and accessories to the chain exceeded $5,000,000. Management of Blue \& Gray believed that sales to the chain contributed significantly to overhead and profit as we as to stable employment. However, during peak periods of sales, the company purchased parts and accessories from smaller firms for use in its own product line as well as to complete orders fo the chain. In March 1992, the treasurer, production manager, and purchasing agent met to decide whether produce or purchase from an outside supplier 2,000 reduction gears, which were part of an order for the retail chain. The Blue \& Gray cost accounting system recorded actual material costs. However, product costing of direct labor was at a standard rate per hour. The treasurer recognize that this use of a standard rate per hour for all operations resulted in some error in costing individual parts. He believed, however, that the standard labor rate was accurate enough for practical purposes, since actual labor rates did not vary widely and, in most instances, parts passed through similar machining operations. Both fixed and variable overhead were charged to products at the standard rate per direct labor hour. The current labor rates and the overhead accounts, as they were grouped by the company according to their fixed or variable characteristics, are shown below. The production manager, Duncan Gray, stated that Blue \& Gray could make the gears in a continuous production run at 200 per hour. Furthermore, there was sufficient free machine time that other production would not be influenced unfavorable by the addition of this order. The material for the gears, he reported, would cost $1,000. The purchasing agent, Elwood Blue, observed that a smaller company would sell the gears to Blue \& Gray at a price of $0.6322 per gear. Vendor evaluation personnel have given the firm a high rating. The final decision on what to do is up to Elwood, the purchasing agent. DISCUSSION QUESTIONS 1. What should Elwood recommend: make or buy? 2. How should he justify his decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts