Question: .Please use at least 4 decimal places accuracy Please show all the inputs entered in financial calculator. Partial credit will be given if the procedure

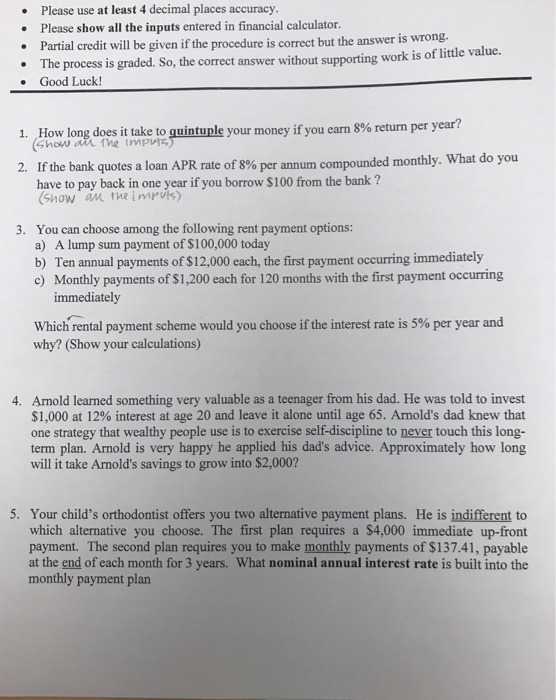

.Please use at least 4 decimal places accuracy Please show all the inputs entered in financial calculator. Partial credit will be given if the procedure is correct but the answer is wrong The process is graded. So, the correct answer without supporting work is of little value. .Good Luck! 1. How long does it take to quintuple your money if you earn 8% return per year? 2. If the bank quotes a loan APR rate of 8% per annum compounded monthly. What do you have to pay back in one year if you borrow $100 from the bank? Show an the impvls) You can choose among the following rent payment options: a) A lump sum payment of $100,000 today b) Ten annual payments of $12,000 each, the first payment occurring immediately c) Monthly payments of $1,200 each for 120 months with the first payment occurring 3. immediately Which rental payment scheme would you choose if the interest rate is 5% per year and why? (Show your calculations) Arnold learned something very valuable as a teenager from his dad. He was told to invest $1,000 at 12% interest at age 20 and leave it alone until age 65, Arnold's dad knew that one strategy that wealthy people use is to exercise self-discipline to never touch this long- term plan. Arnold is very happy he applied his dad's advice. Approximately how long will it take Arnold's savings to grow into $2,000? 4. 5. Your child's orthodontist offers you two alternative payment plans. He is indifferent to which alternative you choose. The first plan requires a $4,000 immediate up-front payment. The second plan requires you to make monthly payments of $137.41, payable at the end of each month for 3 years. What nominal annual interest rate is built into the monthly payment plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts