Question: Please use Excel and a timeline showing all calculations. % Hide Feedback Partially Correct Vheck My Work Feedback Remember that the YTM on the outstanding

Please use Excel and a timeline showing all calculations.

Please use Excel and a timeline showing all calculations.

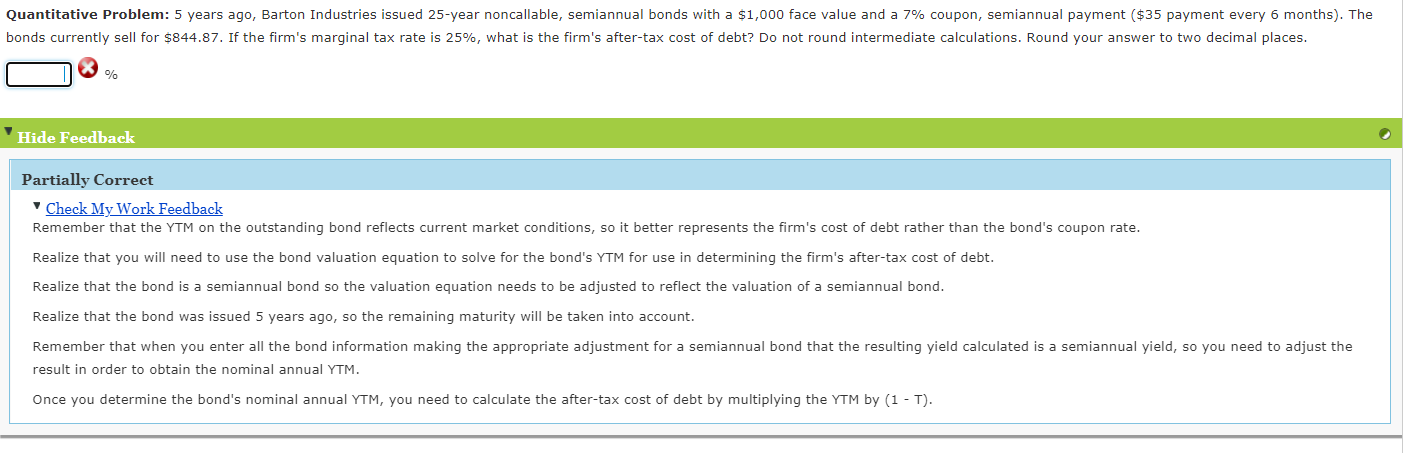

% Hide Feedback Partially Correct Vheck My Work Feedback Remember that the YTM on the outstanding bond reflects current market conditions, so it better represents the firm's cost of debt rather than the bond's coupon rate. Realize that you will need to use the bond valuation equation to solve for the bond's YTM for use in determining the firm's after-tax cost of debt. Realize that the bond is a semiannual bond so the valuation equation needs to be adjusted to reflect the valuation of a semiannual bond. Realize that the bond was issued 5 years ago, so the remaining maturity will be taken into account. result in order to obtain the nominal annual YTM. Once you determine the bond's nominal annual YTM, you need to calculate the after-tax cost of debt by multiplying the YTM by (1 - T)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts