Question: Please use excel and show formulas! Will like if a correct answer, thank you. 11 Calculate the prices of a call option and a put

Please use excel and show formulas! Will "like" if a correct answer, thank you.

Please use excel and show formulas! Will "like" if a correct answer, thank you.

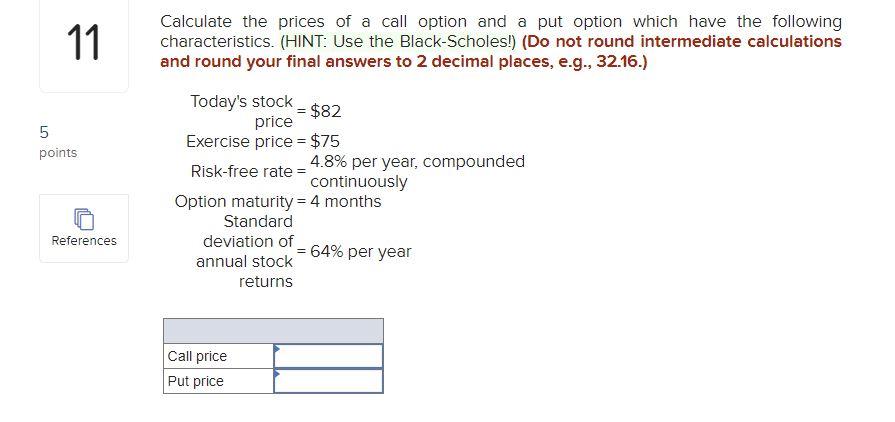

11 Calculate the prices of a call option and a put option which have the following characteristics. (HINT: Use the Black-Scholes!) (Do not round intermediate calculations and round your final answers to 2 decimal places, e.g., 32.16.) 5 points Today's stock = $82 price Exercise price = $75 Risk-free rate=4.8% per year , compounded continuously Option maturity = 4 months Standard deviation of 64% per year annual stock returns References Call price Put price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts