Question: Please use excel and show formulas! Will like if a correct answer, thank you. A company has stock options written on its common stock, with

Please use excel and show formulas! Will "like" if a correct answer, thank you.

Please use excel and show formulas! Will "like" if a correct answer, thank you.

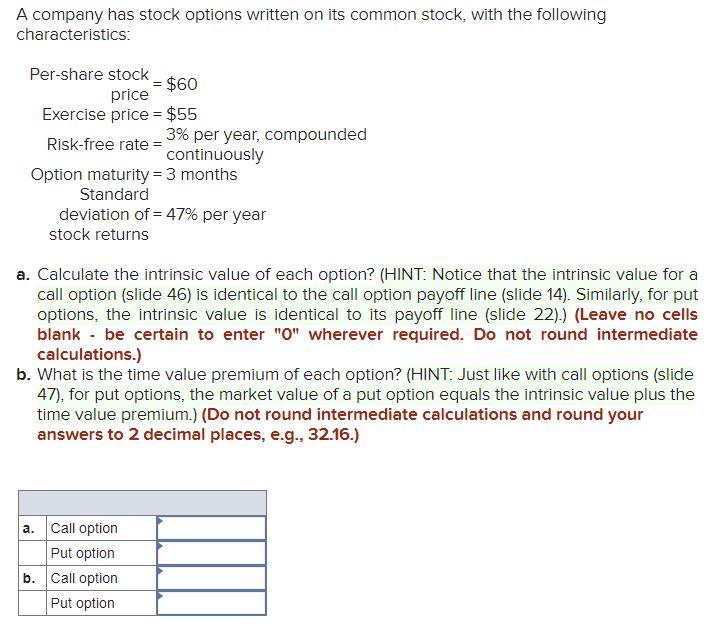

A company has stock options written on its common stock, with the following characteristics: Per-share stock $60 price Exercise price = $55 Risk-free rate 3% per year, compounded continuously Option maturity = 3 months Standard deviation of = 47% per year stock returns a. Calculate the intrinsic value of each option? (HINT: Notice that the intrinsic value for a call option (slide 46) is identical to the call option payoff line (slide 14). Similarly, for put options, the intrinsic value is identical to its payoff line (slide 22).) (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations.) b. What is the time value premium of each option? (HINT: Just like with call options (slide 47), for put options, the market value of a put option equals the intrinsic value plus the time value premium.) (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a. Call option Put option b. Call option Put option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts