Question: Please use excel file to work out the three examples in the exercise example slide and upload your excel file here. Please use all the

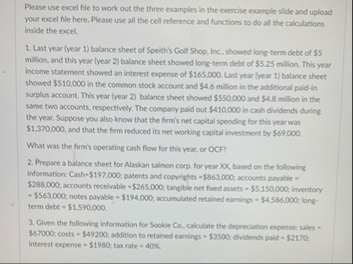

Please use excel file to work out the three examples in the exercise example slide and upload your excel file here. Please use all the cell reference and functions to do all the calculations inside the excel.

Last year year balance sheet of Speith's Goll Shop, Inc. showed longterm debt of $ million, and this year year balance sheet showed longterm debt of $ million. This year Income statement showed an interest expense of $ Last year fear balance sheet showed $ in the common stock account and $million in the additional paidin surplus account. This year year balance sheet showed $ and $ million in the same two accounts, respectively. The company paid out $ in cash dividends during the year. Suppose you also know that the firm's net capital spending for this year was $ and that the firm reduced its net working capital investment by $

What was the frrms operating cash flow for this year, or OCF?

Prepare a balance sheet for Alaskan salmon corp. for year XO based on the following Information: Cash $; patents and copyrights $ : accounts payable $; accounts recelvable $; tangible net fixed assets $; inventory $; notes payable $; accumulated retained earnings $; longterm debt $

Given the following information for Soolie Co calculate the depreciation expense: sales $ : costs $; addition to retained earnings $ : dividends paid $; interest expense $ tax rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock