Question: Please use excel file to work out the examples in the slides for chapter 6 and upload your excel file here. Please use all the

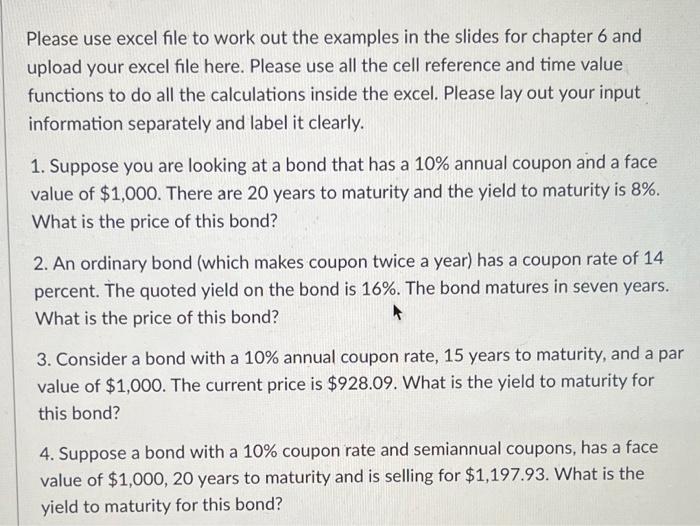

Please use excel file to work out the examples in the slides for chapter 6 and upload your excel file here. Please use all the cell reference and time value functions to do all the calculations inside the excel. Please lay out your input information separately and label it clearly. 1. Suppose you are looking at a bond that has a 10% annual coupon and a face value of $1,000. There are 20 years to maturity and the yield to maturity is 8%. What is the price of this bond? 2. An ordinary bond (which makes coupon twice a year) has a coupon rate of 14 percent. The quoted yield on the bond is 16%. The bond matures in seven years. What is the price of this bond? 3. Consider a bond with a 10% annual coupon rate, 15 years to maturity, and a par value of $1,000. The current price is $928.09. What is the yield to maturity for this bond? 4. Suppose a bond with a 10% coupon rate and semiannual coupons, has a face value of $1,000,20 years to maturity and is selling for $1,197.93. What is the yield to maturity for this bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts