Question: Please use excel formula to solve and show work Question 1 General Lithograph Corporation uses no preferred stock. Their capital structure uses 35% debt (hint:

Please use  excel formula to solve and show work

excel formula to solve and show work

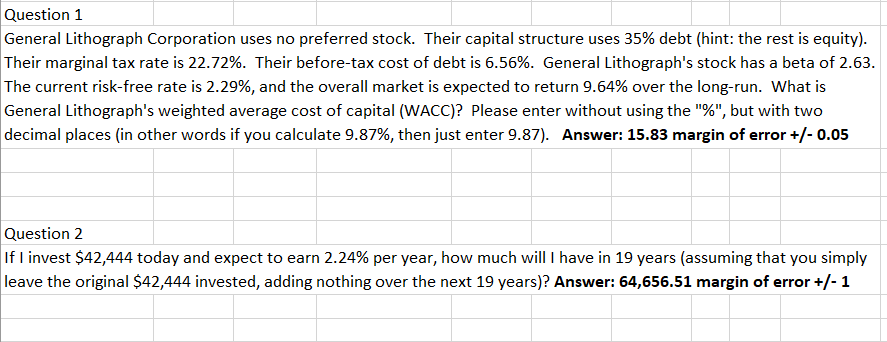

Question 1 General Lithograph Corporation uses no preferred stock. Their capital structure uses 35% debt (hint: the rest is equity). Their marginal tax rate is 22.72%. Their before-tax cost of debt is 6.56%. General Lithograph's stock has a beta of 2.63. The current risk-free rate is 2.29%, and the overall market is expected to return 9.64% over the long-run. What is General Lithograph's weighted average cost of capital (WACC)? Please enter without using the "%", but with two decimal places (in other words if you calculate 9.87%, then just enter 9.87). Answer: 15.83 margin of error +/-0.05 Question 2 If I invest $42,444 today and expect to earn 2.24% per year, how much will I have in 19 years (assuming that you simply leave the original $42,444 invested, adding nothing over the next 19 years)? Answer: 64,656.51 margin of error +/- 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts