Question: Please use excel formulas! Net Present Value Analysis of a Lease or Buy Decision Faster Fashion Stores, Inc., owns a nationwide chain of supermarkets. The

Please use excel formulas!

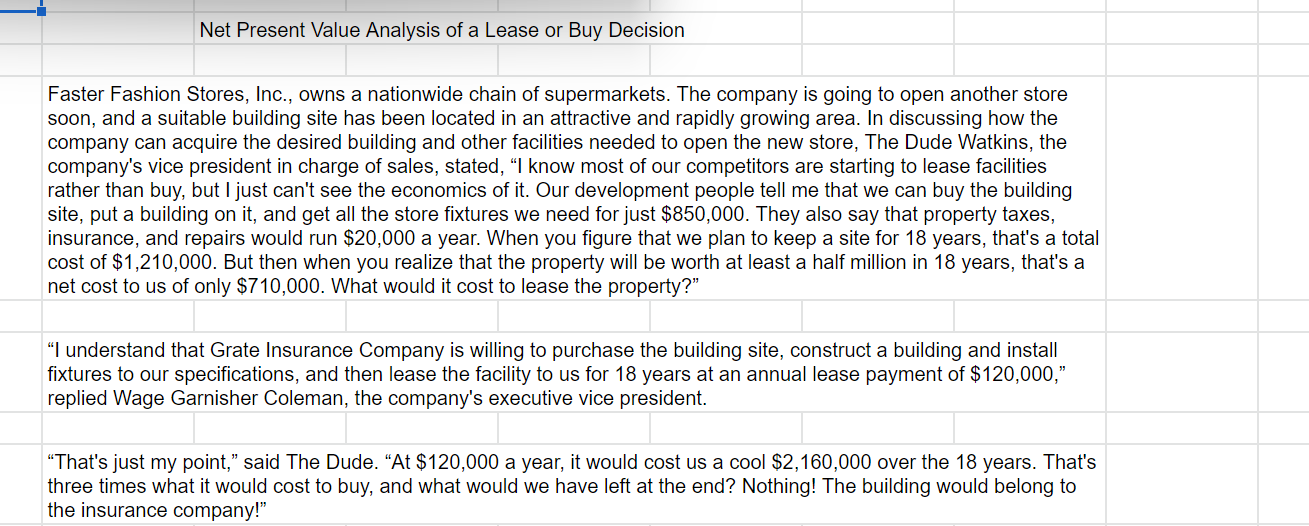

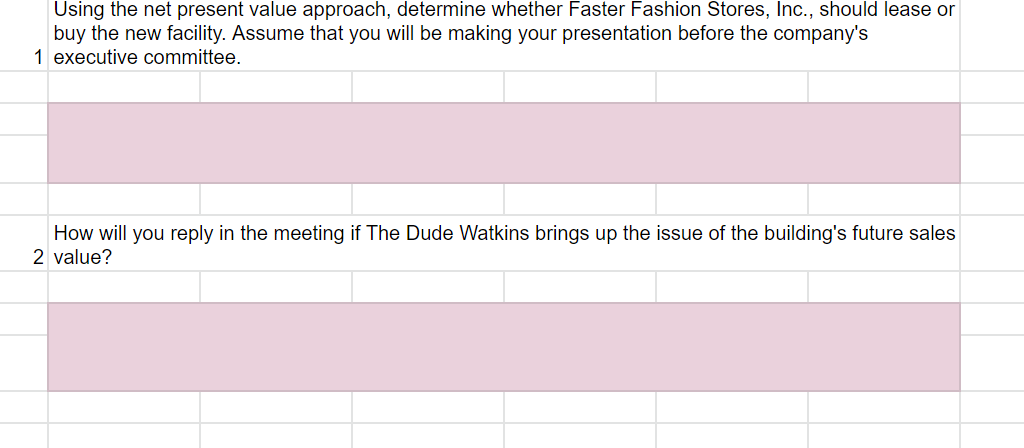

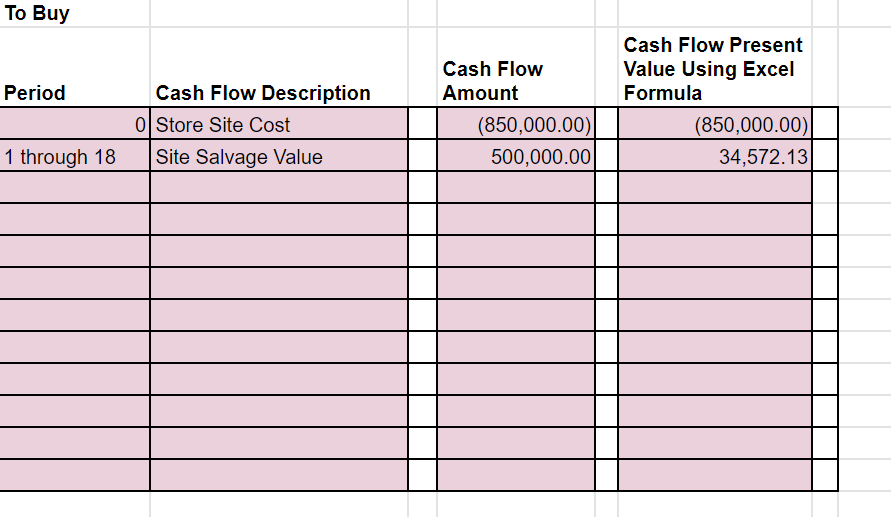

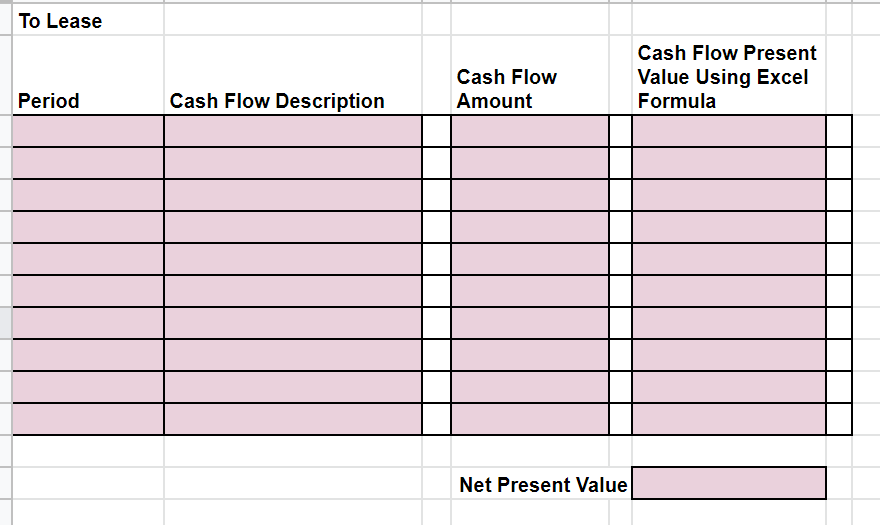

Net Present Value Analysis of a Lease or Buy Decision Faster Fashion Stores, Inc., owns a nationwide chain of supermarkets. The company is going to open another store soon, and a suitable building site has been located in an attractive and rapidly growing area. In discussing how the company can acquire the desired building and other facilities needed to open the new store, The Dude Watkins, the company's vice president in charge of sales, stated, I know most of our competitors are starting to lease facilities rather than buy, but I just can't see the economics of it. Our development people tell me that we can buy the building site, put a building on it, and get all the store fixtures we need for just $850,000. They also say that property taxes, insurance, and repairs would run $20,000 a year. When you figure that we plan to keep a site for 18 years, that's a total cost of $1,210,000. But then when you realize that the property will be worth at least a half million in 18 years, that's a net cost to us of only $710,000. What would it cost to lease the property?" I understand that Grate Insurance Company is willing to purchase the building site, construct a building and install fixtures to our specifications, and then lease the facility to us for 18 years at an annual lease payment of $120,000, replied Wage Garnisher Coleman, the company's executive vice president. "That's just my point," said The Dude. At $120,000 a year, it would cost us a cool $2,160,000 over the 18 years. That's three times what it would cost to buy, and what would we have left at the end? Nothing! The building would belong to the insurance company!" Using the net present value approach, determine whether Faster Fashion Stores, Inc., should lease or buy the new facility. Assume that you will be making your presentation before the company's 1 executive committee. How will you reply in the meeting if The Dude Watkins brings up the issue of the building's future sales 2 value? To Buy Period Cash Flow Description O Store Site Cost Site Salvage Value Cash Flow Amount (850,000.00) 500,000.00 Cash Flow Present Value Using Excel Formula (850,000.00) 34,572.13 1 through 18 To Lease Cash Flow Amount Cash Flow Present Value Using Excel Formula Period Cash Flow Description Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts