Question: please use excel formulas to solve Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million.

please use excel formulas to solve

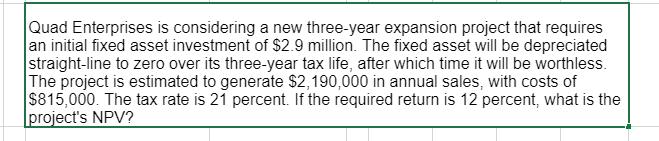

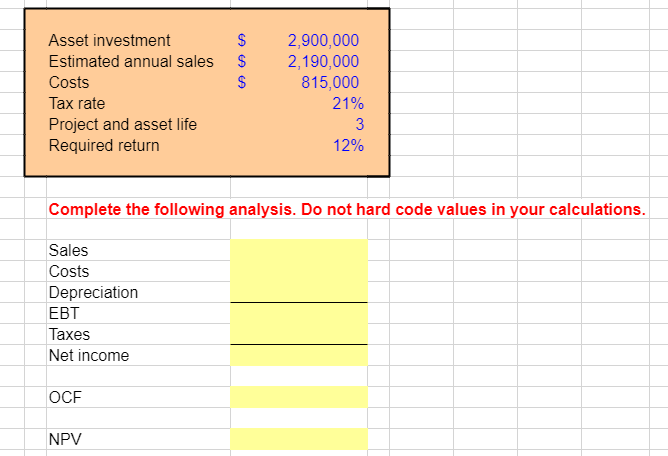

Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,190,000 in annual sales, with costs of $815,000. The tax rate is 21 percent. If the required return is 12 percent, what is the project's NPV? AssetinvestmentEstimatedannualsalesCostsTaxrateProjectandassetlifeRequiredreturn$$$12%2,900,0002,190,000815,00021%3 Complete the following analysis. Do not hard code values in your calculations. Sales Costs Depreciation EBT Taxes Net income OCF NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts