Question: Please use Excel Functions to Solve the Questions! 4. Prof. Business feels like the required 403c monthly deposit is too much of a financial stretch

Please use Excel Functions to Solve the Questions!

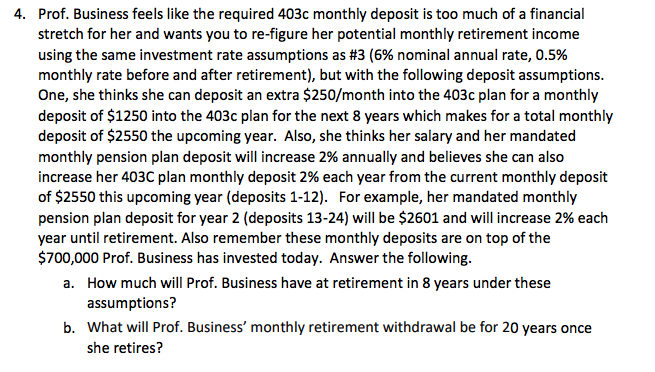

4. Prof. Business feels like the required 403c monthly deposit is too much of a financial stretch for her and wants you to re-figure her potential monthly retirement income using the same investment rate assumptions as #3 (6% nominal annual rate, 0.5% monthly rate before and after retirement), but with the following deposit assumptions. One, she thinks she can deposit an extra $250/month into the 403c plan for a monthly deposit of $1250 into the 403c plan for the next 8 years which makes for a total monthly deposit of $2550 the upcoming year. Also, she thinks her salary and her mandated monthly pension plan deposit will increase 2% annually and believes she can also increase her 403C plan monthly deposit 2% each year from the current monthly deposit of $2550 this upcoming year (deposits 1-12). For example, her mandated monthly pension plan deposit for year 2 (deposits 13-24) will be $2601 and will increase 2% each year until retirement. Also remember these monthly deposits are on top of the $700,000 Prof. Business has invested today. Answer the following. a. How much will Prof. Business have at retirement in 8 years under these assumptions? b. What will Prof. Business' monthly retirement withdrawal be for 20 years once she retires? 4. Prof. Business feels like the required 403c monthly deposit is too much of a financial stretch for her and wants you to re-figure her potential monthly retirement income using the same investment rate assumptions as #3 (6% nominal annual rate, 0.5% monthly rate before and after retirement), but with the following deposit assumptions. One, she thinks she can deposit an extra $250/month into the 403c plan for a monthly deposit of $1250 into the 403c plan for the next 8 years which makes for a total monthly deposit of $2550 the upcoming year. Also, she thinks her salary and her mandated monthly pension plan deposit will increase 2% annually and believes she can also increase her 403C plan monthly deposit 2% each year from the current monthly deposit of $2550 this upcoming year (deposits 1-12). For example, her mandated monthly pension plan deposit for year 2 (deposits 13-24) will be $2601 and will increase 2% each year until retirement. Also remember these monthly deposits are on top of the $700,000 Prof. Business has invested today. Answer the following. a. How much will Prof. Business have at retirement in 8 years under these assumptions? b. What will Prof. Business' monthly retirement withdrawal be for 20 years once she retires

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts