Question: Please use Excel if possible! Please show all formulas and concepts in getting any answer. Will rate thumbs up!! Thank you. 1. The Thomas Frank

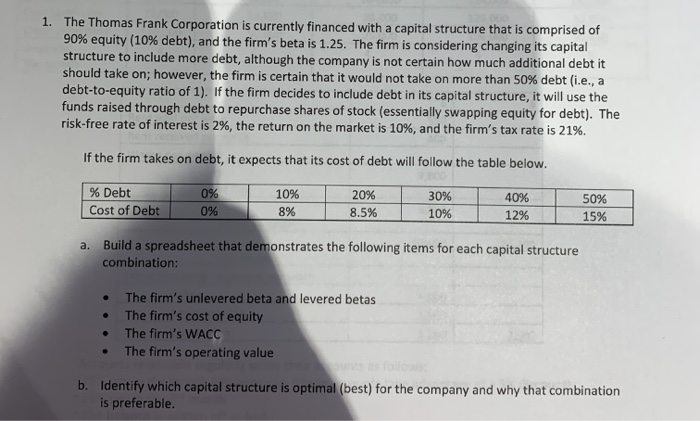

1. The Thomas Frank Corporation is currently financed with a capital structure that is comprised of 90% equity (10% debt), and the firm's beta is 1.25. The firm is considering changing its capital structure to include more debt, although the company is not certain how much additional debt it should take on; however, the firm is certain that it would not take on more than 50% debt (i.e., a debt-to-equity ratio of 1). If the firm decides to include debt in its capital structure, it will use the funds raised through debt to repurchase shares of stock (essentially swapping equity for debt). The risk-free rate of interest is 2%, the return on the market is 10%, and the firm's tax rate is 21%. If the firm takes on debt, it expects that its cost of debt will follow the table below. 0% % Debt Cost of Debt0 10% 10% 8% 20% 8.5% 30% 10% 40% 12% 50% 15% % | a. Build a spreadsheet that demonstrates the following items for each capital structure combination: The firm's unlevered beta and levered betas The firm's cost of equity The firm's WACC The firm's operating value b. Identify which capital structure is optimal (best) for the company and why that combination is preferable. 1. The Thomas Frank Corporation is currently financed with a capital structure that is comprised of 90% equity (10% debt), and the firm's beta is 1.25. The firm is considering changing its capital structure to include more debt, although the company is not certain how much additional debt it should take on; however, the firm is certain that it would not take on more than 50% debt (i.e., a debt-to-equity ratio of 1). If the firm decides to include debt in its capital structure, it will use the funds raised through debt to repurchase shares of stock (essentially swapping equity for debt). The risk-free rate of interest is 2%, the return on the market is 10%, and the firm's tax rate is 21%. If the firm takes on debt, it expects that its cost of debt will follow the table below. 0% % Debt Cost of Debt0 10% 10% 8% 20% 8.5% 30% 10% 40% 12% 50% 15% % | a. Build a spreadsheet that demonstrates the following items for each capital structure combination: The firm's unlevered beta and levered betas The firm's cost of equity The firm's WACC The firm's operating value b. Identify which capital structure is optimal (best) for the company and why that combination is preferable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts