Question: Please use Excel if possible! Please show all formulas and concepts in getting any answer. Will rate thumbs up!! Thank you. 3. The McCullough Corporation

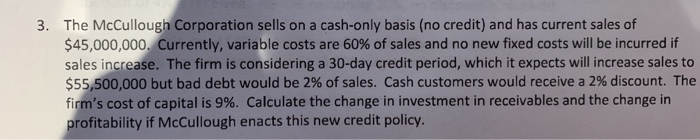

3. The McCullough Corporation sells on a cash-only basis (no credit) and has current sales of $45,000,000. Currently, variable costs are 60% of sales and no new fixed costs will be incurred if sales increase. The firm is considering a 30-day credit period, which it expects will increase sales to $55,500,000 but bad debt would be 2% of sales. Cash customers would receive a 2% discount. The firm's cost of capital is 9%. Calculate the change in investment in receivables and the change in profitability if McCullough enacts this new credit policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts