Question: PLEASE USE EXCEL PV,FV,PMT, RATE INPUT FORMULAS Suppose that a young couple just had their first baby, and they wish to ensure that enough money

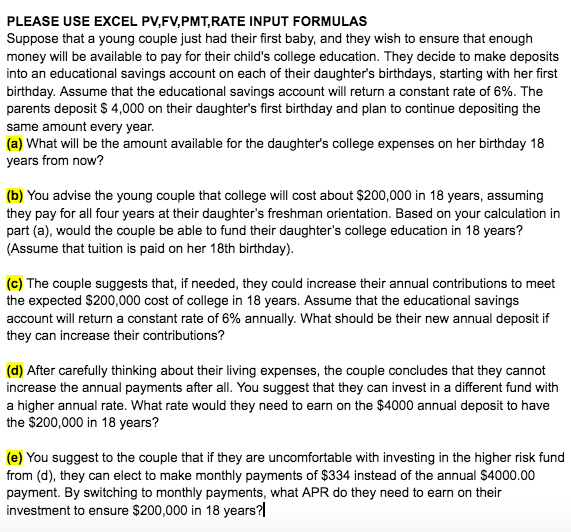

PLEASE USE EXCEL PV,FV,PMT, RATE INPUT FORMULAS Suppose that a young couple just had their first baby, and they wish to ensure that enough money will be available to pay for their child's college education. They decide to make deposits into an educational savings account on each of their daughter's birthdays, starting with her first birthday. Assume that the educational savings account will return a constant rate of 6%. The parents deposit $ 4,000 on their daughter's first birthday and plan to continue depositing the same amount every year. (a) What will be the amount available for the daughter's college expenses on her birthday 18 years from now? (b) You advise the young couple that college will cost about $200,000 in 18 years, assuming they pay for all four years at their daughter's freshman orientation. Based on your calculation in part (a), would the couple be able to fund their daughter's college education in 18 years? (Assume that tuition is paid on her 18th birthday). (c) The couple suggests that, if needed, they could increase their annual contributions to meet the expected $200,000 cost of college in 18 years. Assume that the educational savings account will return a constant rate of 6% annually. What should be their new annual deposit if they can increase their contributions? (d) After carefully thinking about their living expenses, the couple concludes that they cannot increase the annual payments after all. You suggest that they can invest in a different fund with a higher annual rate. What rate would they need to earn on the $4000 annual deposit to have the $200,000 in 18 years? (e) You suggest to the couple that if they are uncomfortable with investing in the higher risk fund from (d), they can elect to make monthly payments of $334 instead of the annual $4000.00 payment. By switching to monthly payments, what APR do they need to earn on their investment to ensure $200,000 in 18 years?||

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts