Question: Please use Excel to answer this question You are at the start of 2022 and you are given the following projections of free cash flows

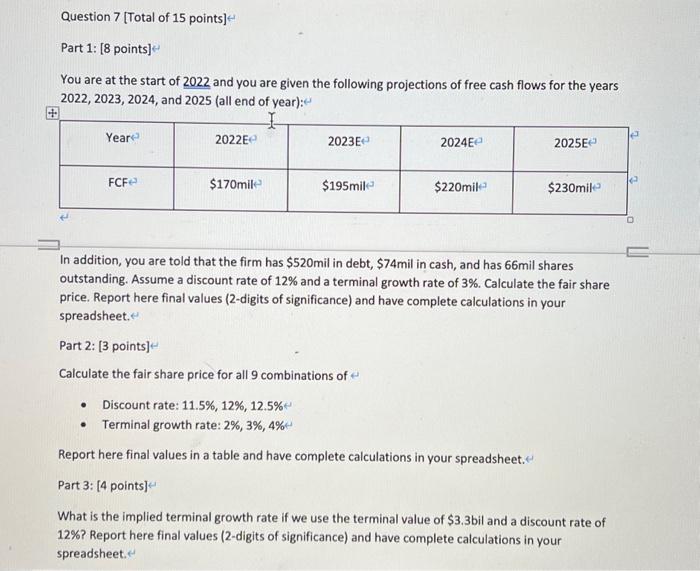

You are at the start of 2022 and you are given the following projections of free cash flows for the years 2022, 2023, 2024, and 2025 (all end of year): In addition, you are told that the firm has $520mil in debt, $74mil in cash, and has 66mil shares outstanding. Assume a discount rate of 12% and a terminal growth rate of 3%. Calculate the fair share price. Report here final values (2-digits of significance) and have complete calculations in your spreadsheet. Part 2: [ 3 points] Calculate the fair share price for all 9 combinations of - Discount rate: 11.5%,12%,12.5% - Terminal growth rate: 2%,3%,4% Report here final values in a table and have complete calculations in your spreadsheet. Part 3: [4 points] What is the implied terminal growth rate if we use the terminal value of $3.3 bil and a discount rate of 12% ? Report here final values (2-digits of significance) and have complete calculations in your spreadsheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts