Question: Please use Excel to complete the problem below. Please submit your solution electronically. Duration and Convexity 1. What is the duration of a 12-year, 7.7%

Please use Excel to complete the problem below. Please submit your solution electronically.

Duration and Convexity

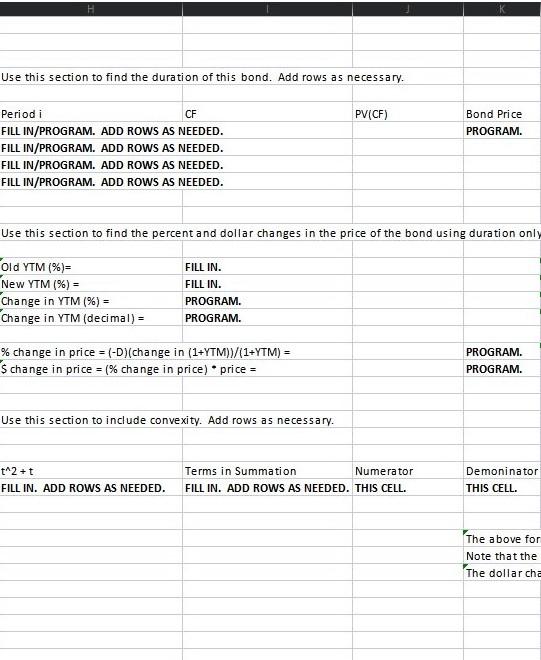

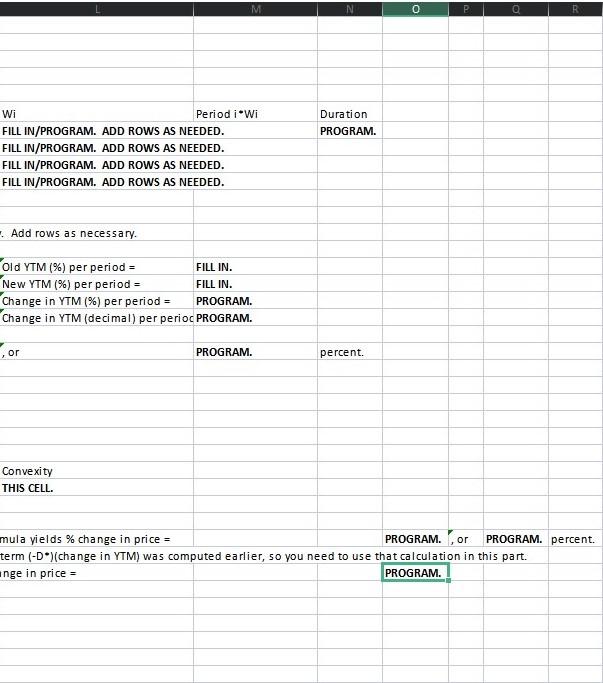

1. What is the duration of a 12-year, 7.7% semi-annual bond if the market rate on bonds of similar quality is 7.5%?

2. Now suppose that the YTM has changed to 7.53%%. Using Macaulay duration (which is practically the same as using modified duration since you need to divide by (1+y)), what is the approximate percent change in the price of the bond? (You do not need to recalculate Macaulay duration using 7.53%. Use the duration value that you found in Problem 1.)

3. Now include convexity to estimate the percent change in the price of the bond.

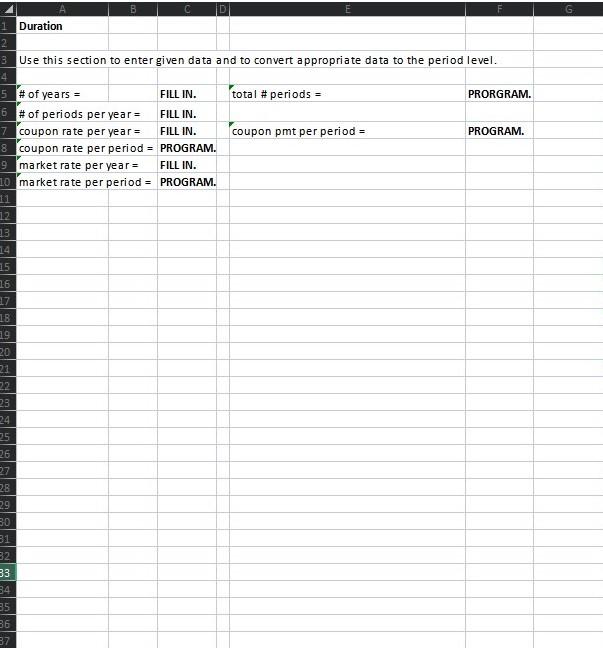

TEMPLATE (Top to Bottom = Left to Right)

D B C 1 Duration 2 3 Use this section to enter given data and to convert appropriate data to the period level. 4 5 # of years = FILL IN. total #periods = PRORGRAM. 6 # of periods per year = FILL IN. 7_coupon rate per year = FILL IN. coupon pmt per period = PROGRAM. 8 coupon rate per period = PROGRAM. 9 market rate per year = FILL IN. 10 market rate per period = PROGRAM. 11 12 3 14 15 16 17 18 19 20 22 23 24 35 26 27 28 29 30 31 32 33 34 35 86 37 H Use this section to find the duration of this bond. Add rows as necessary. PV(CF) Bond Price PROGRAM. Periodi CF FILL IN/PROGRAM. ADD ROWS AS NEEDED. FILL IN/PROGRAM. ADD ROWS AS NEEDED. FILL IN/PROGRAM. ADD ROWS AS NEEDED. FILL IN/PROGRAM. ADD ROWS AS NEEDED. Use this section to find the percent and dollar changes in the price of the bond using duration only Old YTM (%)= New YTM (%) = Change in YTM (%) = Change in YTM (decimal) = FILL IN. FILL IN. PROGRAM PROGRAM. % change in price = (-D) (change in (1+YTM))/(1+YTM) = S change in price = (% change in price) price = PROGRAM PROGRAM. Use this section to include convexity. Add rows as necessary. t^2 +t FILL IN. ADD ROWS AS NEEDED. Terms in Summation Numerator FILL IN. ADD ROWS AS NEEDED. THIS CELL. Demoninator THIS CELL. The above for Note that the The dollar cha M N 0 Q R Duration PROGRAM. Wi Period iwi FILL IN/PROGRAM. ADD ROWS AS NEEDED. FILL IN/PROGRAM. ADD ROWS AS NEEDED. FILL IN/PROGRAM. ADD ROWS AS NEEDED. FILL IN/PROGRAM. ADD ROWS AS NEEDED. - Add rows as necessary. Old YTM (%) per period = FILL IN. New YTM (%) per period = FILL IN. Change in YTM (%) per period = PROGRAM. Change in YTM (decimal) per perioc PROGRAM. 05 PROGRAM. percent. Convexity THIS CELL. mula yields % change in price = PROGRAM. or PROGRAM. percent. term (-D)(change in YTM) was computed earlier, so you need to use that calculation in this part. inge in price = PROGRAM. D B C 1 Duration 2 3 Use this section to enter given data and to convert appropriate data to the period level. 4 5 # of years = FILL IN. total #periods = PRORGRAM. 6 # of periods per year = FILL IN. 7_coupon rate per year = FILL IN. coupon pmt per period = PROGRAM. 8 coupon rate per period = PROGRAM. 9 market rate per year = FILL IN. 10 market rate per period = PROGRAM. 11 12 3 14 15 16 17 18 19 20 22 23 24 35 26 27 28 29 30 31 32 33 34 35 86 37 H Use this section to find the duration of this bond. Add rows as necessary. PV(CF) Bond Price PROGRAM. Periodi CF FILL IN/PROGRAM. ADD ROWS AS NEEDED. FILL IN/PROGRAM. ADD ROWS AS NEEDED. FILL IN/PROGRAM. ADD ROWS AS NEEDED. FILL IN/PROGRAM. ADD ROWS AS NEEDED. Use this section to find the percent and dollar changes in the price of the bond using duration only Old YTM (%)= New YTM (%) = Change in YTM (%) = Change in YTM (decimal) = FILL IN. FILL IN. PROGRAM PROGRAM. % change in price = (-D) (change in (1+YTM))/(1+YTM) = S change in price = (% change in price) price = PROGRAM PROGRAM. Use this section to include convexity. Add rows as necessary. t^2 +t FILL IN. ADD ROWS AS NEEDED. Terms in Summation Numerator FILL IN. ADD ROWS AS NEEDED. THIS CELL. Demoninator THIS CELL. The above for Note that the The dollar cha M N 0 Q R Duration PROGRAM. Wi Period iwi FILL IN/PROGRAM. ADD ROWS AS NEEDED. FILL IN/PROGRAM. ADD ROWS AS NEEDED. FILL IN/PROGRAM. ADD ROWS AS NEEDED. FILL IN/PROGRAM. ADD ROWS AS NEEDED. - Add rows as necessary. Old YTM (%) per period = FILL IN. New YTM (%) per period = FILL IN. Change in YTM (%) per period = PROGRAM. Change in YTM (decimal) per perioc PROGRAM. 05 PROGRAM. percent. Convexity THIS CELL. mula yields % change in price = PROGRAM. or PROGRAM. percent. term (-D)(change in YTM) was computed earlier, so you need to use that calculation in this part. inge in price = PROGRAM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts