Question: Please use EXCEL to do it! Show your answers along with the formula and steps you used for each question Table 1.en January 1,2019 Im

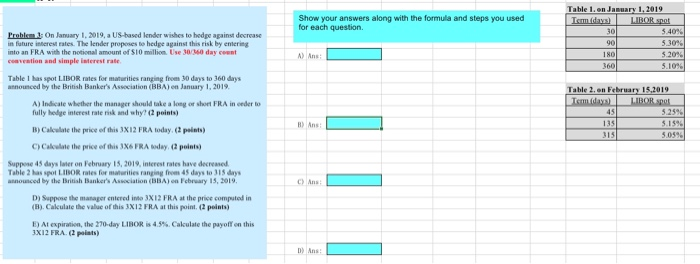

Show your answers along with the formula and steps you used for each question Table 1.en January 1,2019 Im das) LIBOR so 540% Problem 3 On January I, 2019, a US-based lender wishes to hedge against decrease n fature interest rates. The lender proposes to hedge against this risk by entering into an FRA with the notional amount of S10 million Use 30/360 day ceent ceavention and simple isterest rate 520% 510% 360 Table I has spot LIBOR rates for maturities ranging fremm 30 days to 360 days announced by the British Banker's Association (BBA) en January 1, 2019 Table 2. on February 15,2019 A) Indicate whether the manager should take a long or short FRA in oeder t 525% fully hedge interest rate risk and why? (2 points) B) Calcelate the price of this 3X12 FRA today, (2 peints C) Cakelte lhe price of this 3XS , RA day (2 points) 135 Suppose 45 days later on February 15, 2019, interest rates have decreased Table 2 has spot LIBOR rales for maturities ranging from 45 days to 315 dys announced by the British Banker's Association (BBA) on February 15, 2019 D) Suppose the manager entered indo 3X12 FRA at the price computed in (B). Calculate the value of this 3X12 FRA at this point. (2 points) E) Al expiraton, the 270-day L BOR i, 4 5% Calculate the payoff en this 3X12 FRA. (2 poiats) D) Ans Show your answers along with the formula and steps you used for each question Table 1.en January 1,2019 Im das) LIBOR so 540% Problem 3 On January I, 2019, a US-based lender wishes to hedge against decrease n fature interest rates. The lender proposes to hedge against this risk by entering into an FRA with the notional amount of S10 million Use 30/360 day ceent ceavention and simple isterest rate 520% 510% 360 Table I has spot LIBOR rates for maturities ranging fremm 30 days to 360 days announced by the British Banker's Association (BBA) en January 1, 2019 Table 2. on February 15,2019 A) Indicate whether the manager should take a long or short FRA in oeder t 525% fully hedge interest rate risk and why? (2 points) B) Calcelate the price of this 3X12 FRA today, (2 peints C) Cakelte lhe price of this 3XS , RA day (2 points) 135 Suppose 45 days later on February 15, 2019, interest rates have decreased Table 2 has spot LIBOR rales for maturities ranging from 45 days to 315 dys announced by the British Banker's Association (BBA) on February 15, 2019 D) Suppose the manager entered indo 3X12 FRA at the price computed in (B). Calculate the value of this 3X12 FRA at this point. (2 points) E) Al expiraton, the 270-day L BOR i, 4 5% Calculate the payoff en this 3X12 FRA. (2 poiats) D) Ans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts