Question: Please use EXCEL to do it, Thanks! Show your answers along with the formula and steps you used for each question Problem 2: A US-based

Please use EXCEL to do it, Thanks!

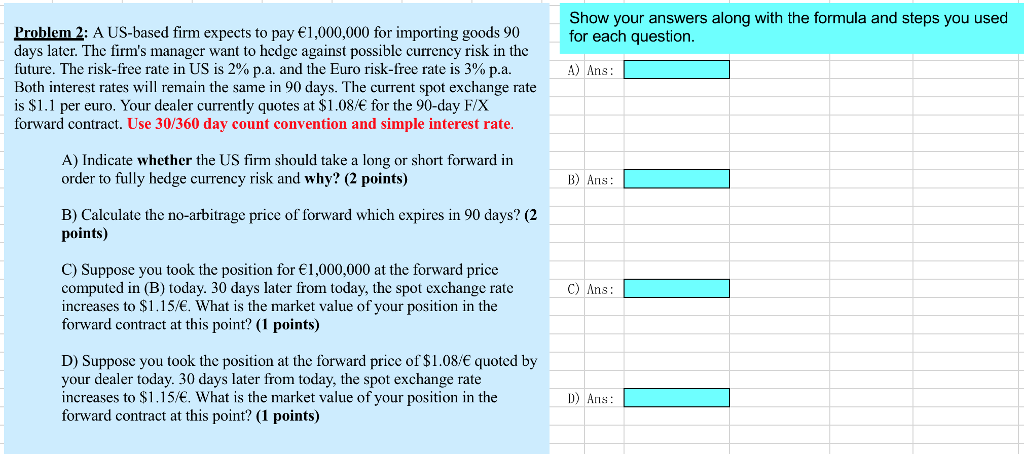

Show your answers along with the formula and steps you used for each question Problem 2: A US-based firm expects to pay 1,000,000 for importing goods 90 days later. Thc firm's manager want to hedgc against possible currency risk in the future. The risk-free rate in US is 2% pa and the Euro risk-free rate is 3% pa Both interest rates will remain the same in 90 days. The current spot exchange rate is $1.1 per euro. Your dealer currently quotes at $1.08/ for the 90-day F/X forward contract. Use 30/360 day count convention and simple interest rate A) Ans: A) Indicate whether the US firm should take a long or short forward in order to fully hedge currency risk and why? (2 points) B) Ans: B) Calculate the no-arbitrage price of forward which expires in 90 days? (2 points) C) Suppose you took the position for 1,000,000 at the forward price computed in (B) today. 30 days later from today, the spot exchange rate increases to $1.15/. What is the market value of your position in the forward contract at this point? (1 points) C) Ans D) Suppose you took the position at the forward price of $1.08/ quoted by your dealer today. 30 days later from today, the spot exchange rate increases to $1.15/. What is the market value of your position in the forward contract at this point? (1 points) D) Ans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts