Question: please use excel to solve all questions and show excel functions used Discount rate, r begin{tabular}{|l|c|l|l|l|l|l|l|l|l|} hline Year & 0 & 1 & 2 &

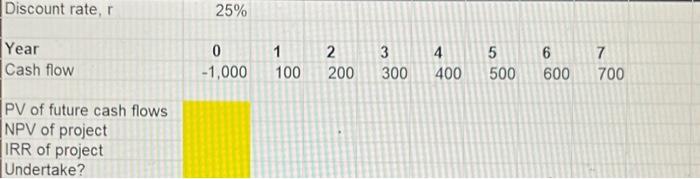

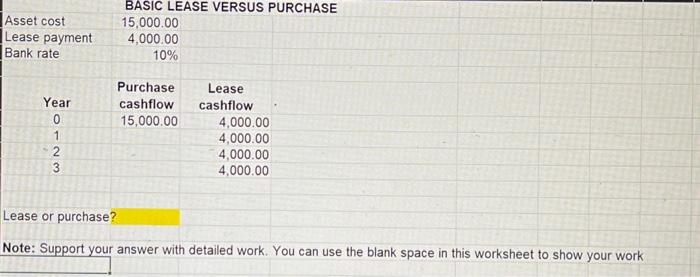

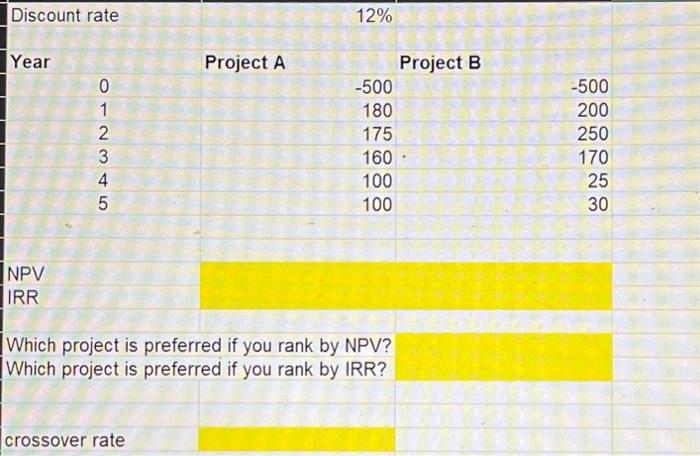

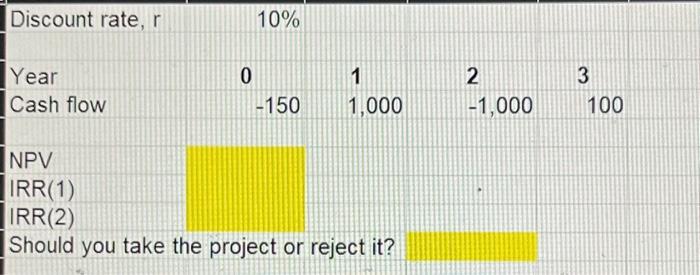

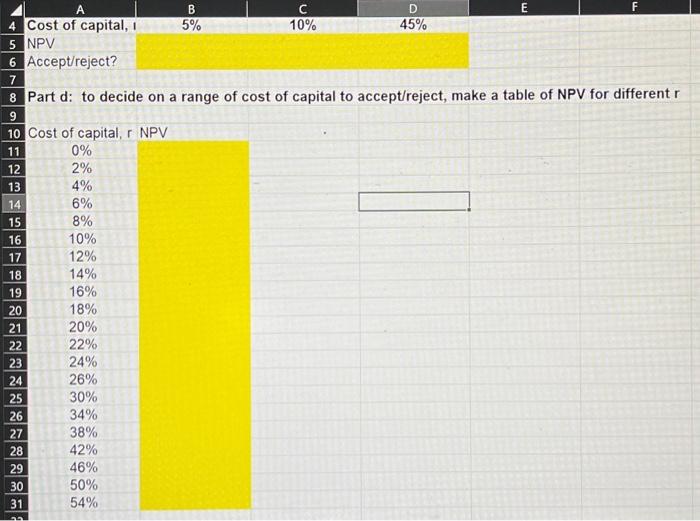

Discount rate, r \begin{tabular}{|l|c|l|l|l|l|l|l|l|l|} \hline Year & 0 & 1 & 2 & 3 & 4 & 5 & 6 & 7 \\ Cash flow & 1,000 & 100 & 200 & 300 & 400 & 500 & 600 & 700 \\ \hline \end{tabular} PV of future cash flows NPV of project IRR of project Undertake? Lease or purchase? Note: Support vour answer with detailed work. You can use the blank space in this worksheet to show your work Part d: to decide on a range of cost of capital to accept/reject, make a table of NPV for different r Discount rate, r 10% YearCashflow015011,00021,0003100 NPV IRR(1) IRR(2) Should you take the project or reject it? Discount rate 12% Year Project A Project B 0 500 500 180 200 2 175 250 160 . 170 4 100 25 5 100 30 NPV IRR Which project is preferred if you rank by NPV? Which project is preferred if you rank by IRR? crossover rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts