Question: Please use excel to solve. The problem and the data provided must be clearly laid out in the spreadsheet and cell referencing must be used.

Please use excel to solve. The problem and the data provided must be clearly laid out in the spreadsheet and cell referencing must be used.

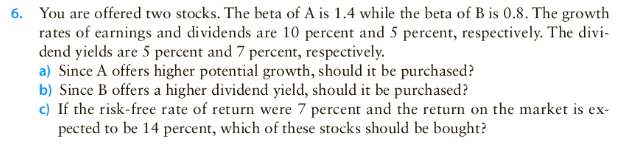

6. You are offered two stocks. The beta of A is 1.4 while the beta of B is 0.8. The growth rates of earnings and dividends are 10 percent and 5 percent, respectively. The divi- dend yields are 5 percent and 7 percent, respectively. a) Since A offers higher potential growth, should it be purchased? b) Since B offers a higher dividend yield, should it be purchased? c) If the risk-free rate of return were 7 percent and the return on the market is ex- pected to be 14 percent, which of these stocks should be bought

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts