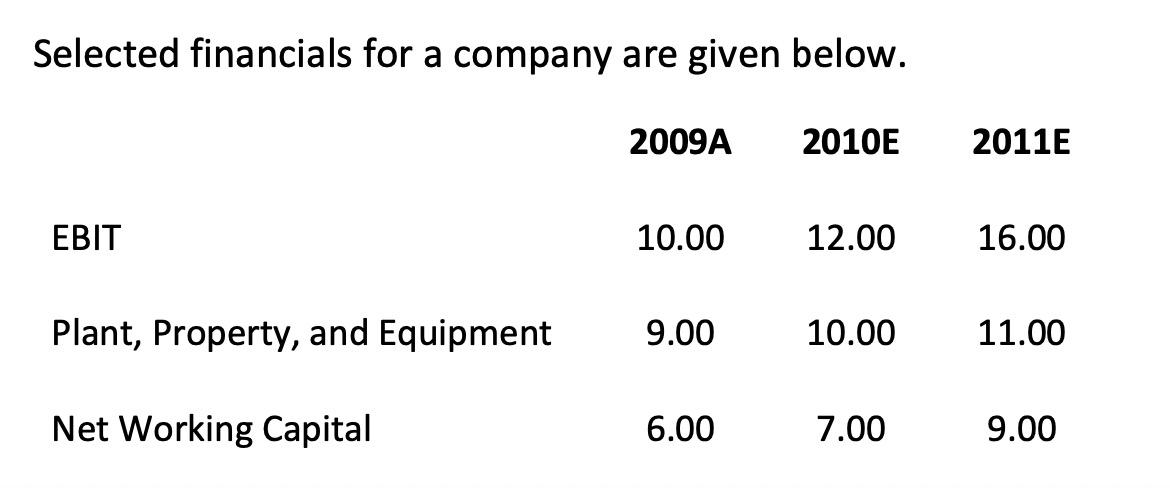

Question: please use excel to solve this problem Today is 1/1/10. After 2011, the firm expects EBIT will continue growing at 2% per year, and for

please use excel to solve this problem

Today is 1/1/10. After 2011, the firm expects EBIT will continue growing at 2% per year, and for PPE and NWC to remain flat. The firms corporate tax rate is 50% and its return on assets (Ra) is 14%.

Assume that the firm gets bought out for $60 today. The buyout is financed by $40 debt. The interest on the debt is 10% (assume Rd=10%), and the debt is paid down using a cash sweep feature. It is expected that the firm will maintain forever the level of debt reached by the end of 2011.

Assume earnings / profits have cash flow impact at end of year. Balance sheet items are as of end of year.

1. What is the debt balance at the end of 2011?

2. What is firm value immediately after the buyout (on 1/1/10)? Assume tax shields as risky as debt.

3. The buyout investors plan to exit at the end of 2011 (assume the exit value is based on the firm value computed at the end of 2011 using the DCF analysis). What is the expected IRR to the equity investors?

Selected financials for a company are given below. 2009A 2010E 2011E EBIT 10.00 12.00 16.00 Plant, Property, and Equipment 9.00 10.00 11.00 Net Working Capital 6.00 7.00 9.00 Selected financials for a company are given below. 2009A 2010E 2011E EBIT 10.00 12.00 16.00 Plant, Property, and Equipment 9.00 10.00 11.00 Net Working Capital 6.00 7.00 9.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts