Question: please Use numbers from 1st picture to answer question. both a, b and C. ( second picture is only there to show the next questions)

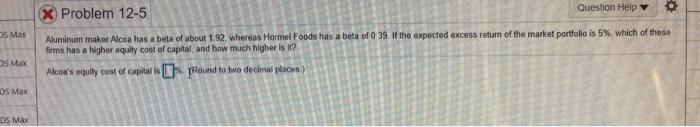

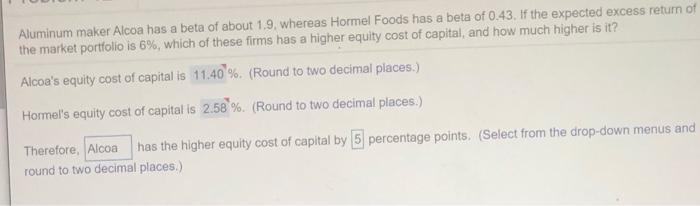

Question Help X Problem 12-5 0 OS Max 3s Max Aluminum maker Alcoa has a beta of about 1.92, whereas Hormel Foods has a beta of 39. the expected excess return of the market portfolio is 5%, which of these firms has a higher equity cost of capital and how much higher is it? Alcoa's equity cont of capital - Round to two decimal place) DS Max OS Max Aluminum maker Alcoa has a beta of about 1.9, whereas Hormel Foods has a beta of 0.43. If the expected excess return of the market portfolio is 6%, which of these firms has a higher equity cost of capital, and how much higher is it? Alcoa's equity cost of capital is 11.407%, (Round to two decimal places.) Hormel's equity cost of capital is 2.58%. (Round to two decimal places.) Therefore, Alcoa has the higher equity cost of capital by 5 percentage points. (Select from the drop-down menus and round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts