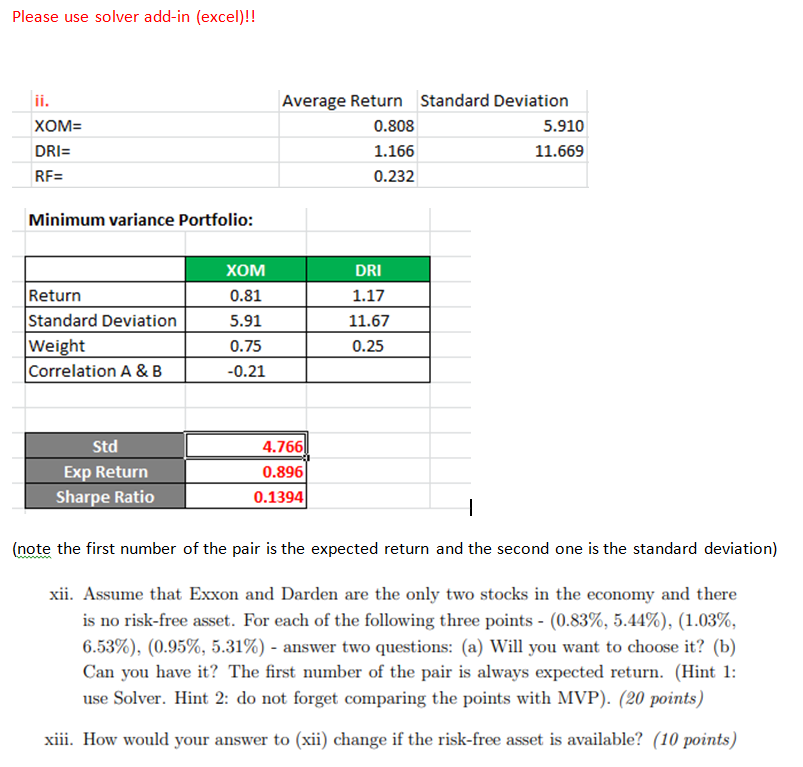

Question: Please use solver add-in (excel)!! ii. XOM= DRI RF= Average Return Standard Deviation 0.808 5.910 1.166 11.669 0.232 Minimum variance Portfolio: Return Standard Deviation Weight

Please use solver add-in (excel)!! ii. XOM= DRI RF= Average Return Standard Deviation 0.808 5.910 1.166 11.669 0.232 Minimum variance Portfolio: Return Standard Deviation Weight Correlation A&B XOM 0.81 5.91 0.75 -0.21 DRI 1.17 11.67 0.25 4.7661 Std Exp Return Sharpe Ratio 0.896 0.1394 I (note the first number of the pair is the expected return and the second one is the standard deviation) xii. Assume that Exxon and Darden are the only two stocks in the economy and there is no risk-free asset. For each of the following three points - (0.83%, 5.44%), (1.03%, 6.53%), (0.95%, 5.31%) - answer two questions: (a) Will you want to choose it? (b) Can you have it? The first number of the pair is always expected return. (Hint 1: use Solver. Hint 2: do not forget comparing the points with MVP). (20 points) xiii. How would your answer to (xii) change if the risk-free asset is available? (10 points) Please use solver add-in (excel)!! ii. XOM= DRI RF= Average Return Standard Deviation 0.808 5.910 1.166 11.669 0.232 Minimum variance Portfolio: Return Standard Deviation Weight Correlation A&B XOM 0.81 5.91 0.75 -0.21 DRI 1.17 11.67 0.25 4.7661 Std Exp Return Sharpe Ratio 0.896 0.1394 I (note the first number of the pair is the expected return and the second one is the standard deviation) xii. Assume that Exxon and Darden are the only two stocks in the economy and there is no risk-free asset. For each of the following three points - (0.83%, 5.44%), (1.03%, 6.53%), (0.95%, 5.31%) - answer two questions: (a) Will you want to choose it? (b) Can you have it? The first number of the pair is always expected return. (Hint 1: use Solver. Hint 2: do not forget comparing the points with MVP). (20 points) xiii. How would your answer to (xii) change if the risk-free asset is available? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts