Question: please use spreadsheets and show formulas 57 Question 9 (10 points) ELEM Corporation's stock price is currently trading at $110. The investor is considering of

please use spreadsheets and show formulas

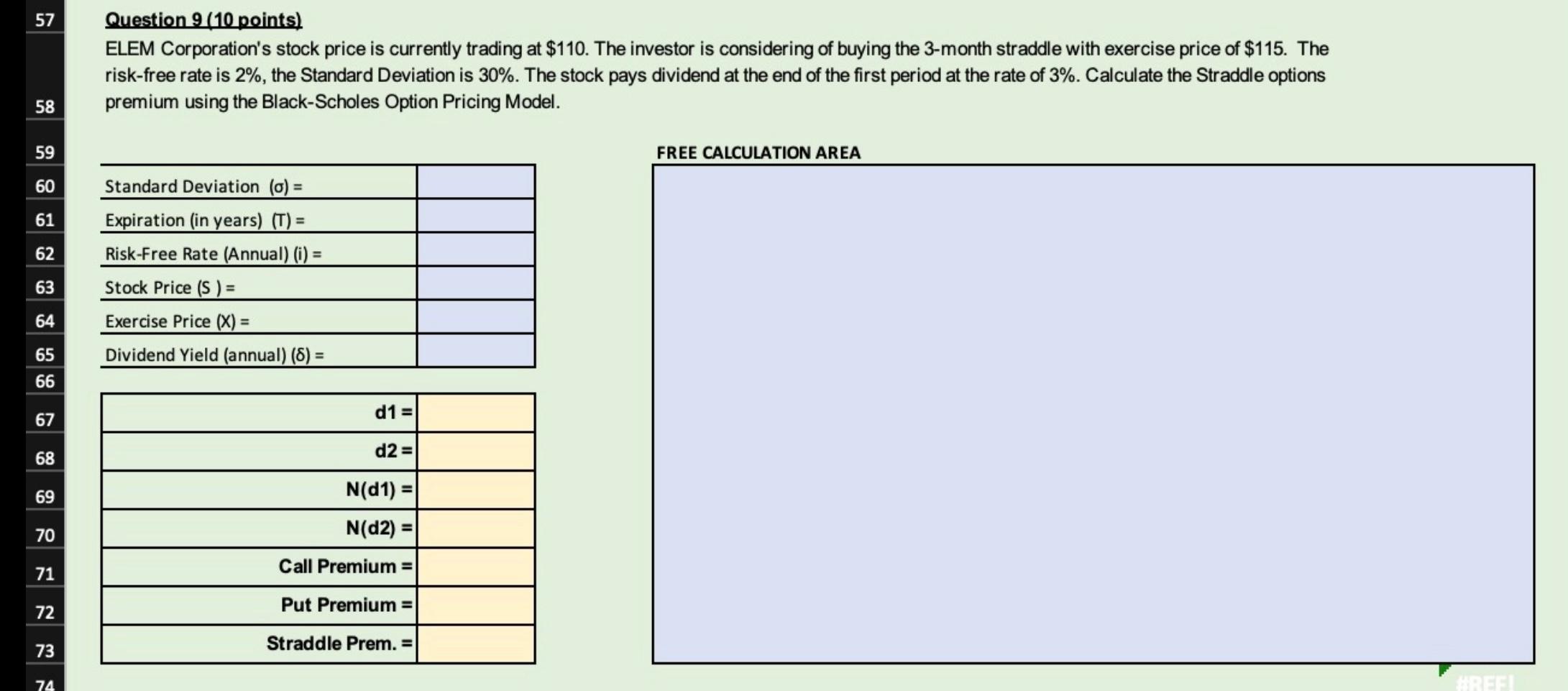

57 Question 9 (10 points) ELEM Corporation's stock price is currently trading at $110. The investor is considering of buying the 3-month straddle with exercise price of $115. The risk-free rate is 2%, the Standard Deviation is 30%. The stock pays dividend at the end of the first period at the rate of 3%. Calculate the Straddle options premium using the Black-Scholes Option Pricing Model. 58 59 FREE CALCULATION AREA 60 61 62 63 Standard Deviation (o) = Expiration (in years) (T) = Risk-Free Rate (Annual) (i) = Stock Price (s ) = Exercise Price (X) = Dividend Yield (annual) (8) = 64 65 66 d1 = 67 d2= 68 69 N(D1) = 70 N(d2) = Call Premium = 71 Put Premium = 72 73 Straddle Prem. = 74 REF 57 Question 9 (10 points) ELEM Corporation's stock price is currently trading at $110. The investor is considering of buying the 3-month straddle with exercise price of $115. The risk-free rate is 2%, the Standard Deviation is 30%. The stock pays dividend at the end of the first period at the rate of 3%. Calculate the Straddle options premium using the Black-Scholes Option Pricing Model. 58 59 FREE CALCULATION AREA 60 61 62 63 Standard Deviation (o) = Expiration (in years) (T) = Risk-Free Rate (Annual) (i) = Stock Price (s ) = Exercise Price (X) = Dividend Yield (annual) (8) = 64 65 66 d1 = 67 d2= 68 69 N(D1) = 70 N(d2) = Call Premium = 71 Put Premium = 72 73 Straddle Prem. = 74 REF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts