Question: PLEASE USE TEMPLATE AT THE BOTTOM TO ANSWER QUESTION The ABC Corporation is considering opening an office in a new market area that would allow

PLEASE USE TEMPLATE AT THE BOTTOM TO ANSWER QUESTION

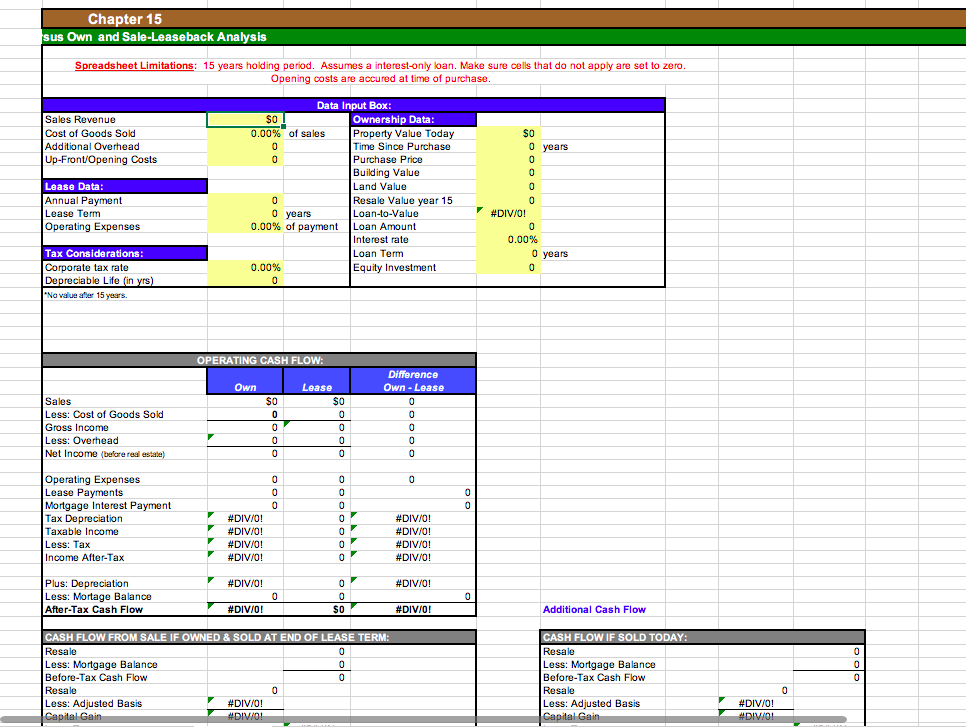

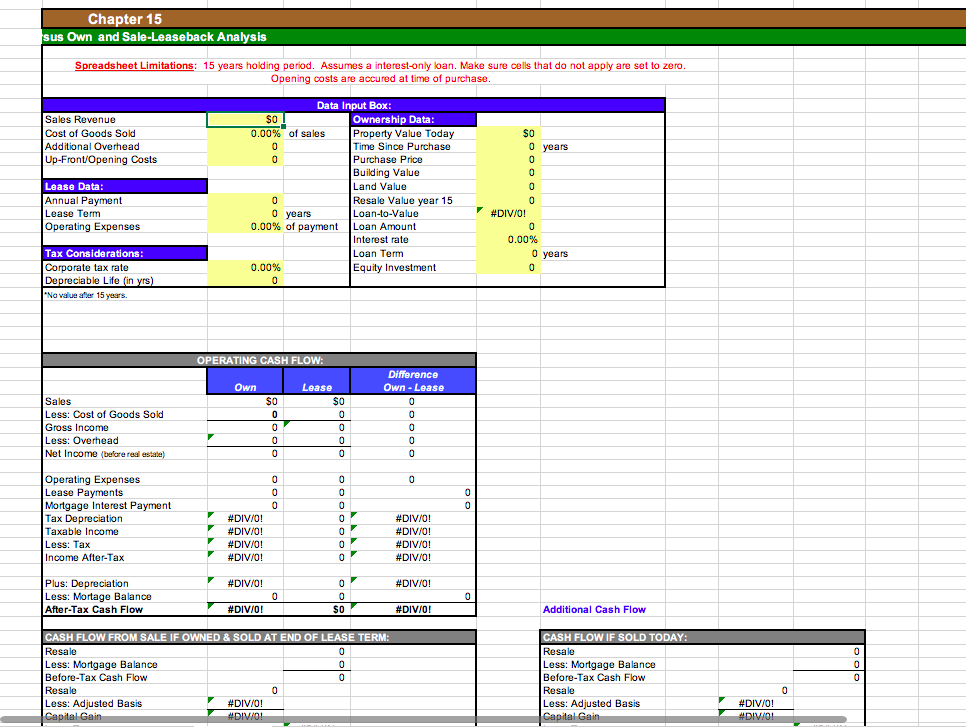

The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. Cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $300,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $3.9 million, of which $600,000 of the purchase price would represent land value, and $3.3 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 30 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $450,000 per year for a term of 15 years, with the corporation paying all real estate operating expenses (absolute net lease). Real estate operating expenses are estimated to be 50 percent of the lease payments. Estimates are that the property value will increase over the 15-year lease term for a sale price of $4.9 million at the end of the 15 years. If the property is purchased, it would be financed with an interest-only mortgage for $2,730,000 at an interest rate of 10 percent with a balloon payment due after 15 years. a. What is the return from opening the office building under the assumption that it is leased? b. What is the return from opening the office building under the assumption that it is owned? c. What is the return on the incremental cash flow from owning versus leasing? d. In general, what other factors might the firm consider before deciding whether to lease or own? Chapter 15 sus Own and Sale-Leaseback Analysis Spreadsheet Limitations: 15 years holding period. Assumes a interest-only loan. Make sure cells that do not apply are set to zero. Opening costs are accured at time of purchase. Sales Revenue Cost of Goods Sold Additional Overhead Up-Front/Opening Costs years Lease Data: Annual Payment Lease Term Operating Expenses Data Input Box: Ownership Data: 0.00% of sales Property Value Today Time Since Purchase Purchase Price Building Value Land Value Resale Value year 15 0 years Loan-to-Value 0.00% of payment Loan Amount Interest rate Loan Term 0.00% Equity Investment #DIV/0! 0.00% 0 years Tax Considerations: Corporate tax rate No fin vrs) Depreciable Life (in yrs) "No value atler 15 years. OPERATING CASH FLOW: Difference Own - Lease Own Lease SO O Sales Less: Cost of Goods Sold Gross Income Less: Overhead Net Income (before real estate) 0 0 0 0 Operating Expenses Lease Payments Mortgage Interest Payment Tax Depreciation Taxable income Less: Tax Income After-Tax #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Plus: Depreciation Less: Mortage Balance After-Tax Cash Flow 0 #DIVIOI $O #DIV/0! Additional Cash Flow CASH FLOW FROM SALE IF OWNED & SOLD AT END OF LEASE TERM: Rosale Less: Mortgage Balance dane Balance Before-Tax Cash Flow 0 Resale Less: Adjusted Basis #DIV/0! Capital Gain #DIV/O! CASH FLOW IF SOLD TODAY: Resale Less: Mortgage Balance Before-Tax Cash Flow Resale Less: Adjusted Basis Capital Gain #DIV/0! #DIV/O! The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. Cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $300,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $3.9 million, of which $600,000 of the purchase price would represent land value, and $3.3 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 30 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $450,000 per year for a term of 15 years, with the corporation paying all real estate operating expenses (absolute net lease). Real estate operating expenses are estimated to be 50 percent of the lease payments. Estimates are that the property value will increase over the 15-year lease term for a sale price of $4.9 million at the end of the 15 years. If the property is purchased, it would be financed with an interest-only mortgage for $2,730,000 at an interest rate of 10 percent with a balloon payment due after 15 years. a. What is the return from opening the office building under the assumption that it is leased? b. What is the return from opening the office building under the assumption that it is owned? c. What is the return on the incremental cash flow from owning versus leasing? d. In general, what other factors might the firm consider before deciding whether to lease or own? Chapter 15 sus Own and Sale-Leaseback Analysis Spreadsheet Limitations: 15 years holding period. Assumes a interest-only loan. Make sure cells that do not apply are set to zero. Opening costs are accured at time of purchase. Sales Revenue Cost of Goods Sold Additional Overhead Up-Front/Opening Costs years Lease Data: Annual Payment Lease Term Operating Expenses Data Input Box: Ownership Data: 0.00% of sales Property Value Today Time Since Purchase Purchase Price Building Value Land Value Resale Value year 15 0 years Loan-to-Value 0.00% of payment Loan Amount Interest rate Loan Term 0.00% Equity Investment #DIV/0! 0.00% 0 years Tax Considerations: Corporate tax rate No fin vrs) Depreciable Life (in yrs) "No value atler 15 years. OPERATING CASH FLOW: Difference Own - Lease Own Lease SO O Sales Less: Cost of Goods Sold Gross Income Less: Overhead Net Income (before real estate) 0 0 0 0 Operating Expenses Lease Payments Mortgage Interest Payment Tax Depreciation Taxable income Less: Tax Income After-Tax #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Plus: Depreciation Less: Mortage Balance After-Tax Cash Flow 0 #DIVIOI $O #DIV/0! Additional Cash Flow CASH FLOW FROM SALE IF OWNED & SOLD AT END OF LEASE TERM: Rosale Less: Mortgage Balance dane Balance Before-Tax Cash Flow 0 Resale Less: Adjusted Basis #DIV/0! Capital Gain #DIV/O! CASH FLOW IF SOLD TODAY: Resale Less: Mortgage Balance Before-Tax Cash Flow Resale Less: Adjusted Basis Capital Gain #DIV/0! #DIV/O